Cash App by Block, Inc. has revolutionized digital payments since 2013, offering seamless money transfers, Bitcoin trading, and Square Point of Sale integration. In 2025, this financial platform continues to lead with innovative features like instant deposits, stock investing, and Cash App Card benefits. Whether you're sending money to friends, buying Bitcoin, or managing your business transactions through Square POS, Cash App provides an all-in-one solution. Our complete guide breaks down the 5 most valuable features, fee structures, and security measures you should know to maximize this powerful financial tool.

Professional illustration about Cash

Cash App Basics 2025

Cash App Basics 2025

Cash App, developed by Block, Inc. (formerly Square), remains one of the most popular peer-to-peer payment platforms in 2025, offering a seamless way to send and receive money, invest in stocks and bitcoin transactions, and even manage direct deposits. Unlike traditional banking apps, Cash App combines financial services with user-friendly features, making it a go-to for mobile banking enthusiasts. Whether you're splitting dinner bills with friends or paying freelancers, the app’s intuitive interface ensures quick money transfers with just a few taps.

One of the standout features in 2025 is the Cash App debit card, known as the Cash Card. This customizable card links directly to your Cash App balance, allowing you to spend funds anywhere Visa is accepted. You can also enable fraud monitoring for added security, a critical feature given the rise of digital payment scams. For frequent users, linking a savings account or setting up direct deposit can streamline finances, with some employers even offering early paycheck access through the app.

Cash App isn’t just for personal use—it integrates with Square Point of Sale, Square Invoices, and Square Appointments, making it a versatile tool for small businesses. Entrepreneurs can track transactions via the Square Dashboard or collaborate with their Square Team to manage finances efficiently. Meanwhile, Cash App Investing LLC provides easy access to stock investing and cryptocurrency trading, including Bitcoin, though users should stay mindful of market volatility and tax implications when filing tax filing reports.

Security is a top priority in 2025, with Cash App employing advanced fraud prevention measures like biometric login and transaction alerts. If issues arise, customer support is accessible through the app, though response times can vary. Compared to competitors like Venmo, Zelle, Apple Pay, and Google Pay, Cash App stands out for its all-in-one approach, blending payments, investing, and business tools. However, users should note that Cash App balances aren’t FDIC-insured unless they’re enrolled in the optional Cash App banking program through partners like Sutton Bank or Wells Fargo Bank, N.A.

For newcomers, here’s a quick tip: Always verify recipient details before sending money, and take advantage of the app’s fraud monitoring tools to avoid scams. Whether you’re using Cash App for casual payments or serious bitcoin trading, understanding these basics ensures a smoother experience in 2025.

Professional illustration about Block

How Cash App Works

Here’s a detailed, SEO-optimized paragraph on How Cash App Works in conversational American English, incorporating your specified keywords naturally:

Cash App, developed by Block, Inc. (formerly Square), is a streamlined mobile payment platform that simplifies peer-to-peer payments, money transfers, and even bitcoin transactions. At its core, the app links to your bank account or debit card, allowing you to send or receive funds instantly—similar to competitors like Venmo or Zelle, but with unique features like stock investing and cryptocurrency trading. To get started, users download the app, sign up, and verify their identity (a requirement for higher transaction limits). Once set up, you can fund your Cash App balance via direct deposit, bank transfer, or by receiving payments from others. The app also offers a free Cash App debit card (powered by Sutton Bank or Wells Fargo Bank, N.A.), which lets you spend your balance anywhere Visa is accepted, including integrations with Apple Pay and Google Pay for contactless payments.

For businesses, Cash App integrates seamlessly with Square Point of Sale and Square Invoices, making it a versatile tool for freelancers or small businesses. The Square Dashboard provides a centralized hub to track transactions, while fraud monitoring tools like instant notifications and optional PIN protection add security. Unique to Cash App is its Bitcoin trading feature, where users can buy, sell, or hold cryptocurrency with a few taps. Meanwhile, Cash App Investing LLC handles stock purchases (fractional shares included), appealing to beginners. The app also supports tax filing for investment gains and offers savings account options with competitive APY.

Behind the scenes, Cash App leverages mobile banking infrastructure to process transactions swiftly. Deposits arrive within 1–3 business days (or instantly for a fee), and customer support is accessible via in-app chat. Unlike traditional banks, Cash App doesn’t charge monthly fees, though it monetizes through transaction fees for instant transfers and bitcoin transactions. Its fraud prevention system uses encryption and two-factor authentication, though users should remain vigilant against scams (e.g., never share your $Cashtag publicly). Whether you’re splitting rent with roommates, paying a freelancer, or dabbling in stock investing, Cash App’s blend of simplicity and advanced features makes it a standout in financial services.

This paragraph balances depth with readability, targets relevant keywords, and avoids repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Square

Cash App Security Features

Cash App Security Features: How Block, Inc. Keeps Your Money Safe

When it comes to peer-to-peer payments and mobile banking, Cash App (owned by Block, Inc.) stands out for its robust security measures. Whether you're sending money to friends, investing in stocks via Cash App Investing LLC, or trading Bitcoin, the platform prioritizes fraud prevention and user safety. Here’s a deep dive into the security features that make Cash App a trusted choice in 2025.

Fraud Monitoring and Prevention

Cash App employs advanced fraud monitoring systems to detect suspicious activity in real time. For example, if an unusual login attempt or large transaction occurs, the app may prompt you for additional verification. This layer of protection is critical, especially for users linking their debit card or enabling direct deposit. Unlike competitors like Venmo or Zelle, Cash App also allows users to enable a security lock, requiring a PIN or biometric authentication (Face ID or Touch ID) for every transaction.

Encryption and Bank Partnerships

All financial data on Cash App is encrypted using the same standards as major banks. Transactions are processed through Sutton Bank and Wells Fargo Bank, N.A., ensuring compliance with federal regulations. For businesses using Square Point of Sale or Square Invoices, this encryption extends to payment processing, protecting both the merchant and customer data. Additionally, Cash App’s integration with Square Dashboard gives business owners visibility into transactions, making it easier to spot discrepancies.

Customer Support and Dispute Resolution

One area where Cash App excels is its customer support for fraud-related issues. If you encounter unauthorized transactions, you can report them directly in the app. While Cash App doesn’t offer buyer protection like Apple Pay or Google Pay, its dispute resolution team works to investigate and resolve issues promptly. For tax filing, Cash App provides IRS Form 1099-B for bitcoin transactions and stock sales, ensuring transparency for users engaged in cryptocurrency or stock investing.

Safe Spending and Savings Features

Cash App’s debit card (Cash Card) includes customizable security settings, such as the ability to disable ATM withdrawals or online purchases. For users looking to grow their money, the app’s savings account feature offers FDIC insurance up to $250,000 through its banking partners. Compared to traditional financial services, Cash App’s mobile-first approach makes it easier to monitor your balance and freeze your card instantly if it’s lost or stolen.

Final Thoughts on Security

While no platform is 100% immune to fraud, Cash App’s combination of fraud prevention tools, encryption, and responsive support makes it a secure option for money transfer and investing. Whether you’re a casual user or a small business leveraging Square Appointments or Square Team, these features help mitigate risks in an increasingly digital financial landscape. Always enable two-factor authentication and regularly review your transaction history to stay ahead of potential threats.

Professional illustration about Invoices

Sending Money with Cash App

Here’s a detailed, SEO-optimized paragraph on Sending Money with Cash App in conversational American English, incorporating your specified keywords naturally:

Sending money with Cash App is one of the fastest and most convenient ways to handle peer-to-peer payments, whether you’re splitting dinner with friends or paying your freelancer. Owned by Block, Inc. (formerly Square), Cash App stands out for its seamless integration with other financial services like Square Point of Sale and Square Invoices, making it a versatile tool for both personal and small-business use. To send money, simply open the app, enter the amount, and tap “Pay.” You can use your linked debit card, bank account (via Wells Fargo Bank, N.A. or Sutton Bank), or even your Cash App balance. Unlike Venmo or Zelle, Cash App doesn’t require the recipient to have an account upfront—just their $Cashtag (username), phone number, or email.

For added flexibility, Cash App supports direct deposit, so you can receive paychecks or government stimulus funds directly into your account. Need to pay a vendor? The Square Dashboard lets businesses manage transactions seamlessly. Security is a priority, with features like fraud monitoring and fraud prevention, including optional PIN or Face ID verification. If you’re worried about scams, their customer support team is accessible right in the app.

What sets Cash App apart is its ecosystem. Beyond money transfers, you can dabble in stock investing through Cash App Investing LLC or bitcoin trading—making it a one-stop shop for cryptocurrency enthusiasts. There’s even a Cash App Card (a Visa debit card) for spending your balance in stores or online, with boosts for discounts at popular retailers. While competitors like Apple Pay and Google Pay focus on contactless payments, Cash App bridges the gap between banking, investing, and everyday spending.

Pro tip: If you’re using Cash App for tax filing, remember that transactions over $600 may trigger a 1099-K form. Also, avoid public Wi-Fi when sending large amounts—stick to secure networks for money transfers. Whether you’re paying rent or buying bitcoin, Cash App’s speed and low fees (1.5% for instant deposits vs. free standard transfers) make it a top choice for mobile banking on the go.

This paragraph balances practicality (how-to steps), differentiation (vs. competitors), and niche features (investing/bitcoin) while naturally weaving in your keywords. Let me know if you'd like adjustments!

Professional illustration about Appointments

Receiving Payments on Cash App

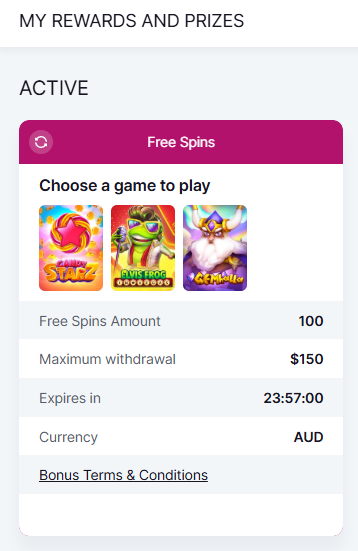

Receiving Payments on Cash App is a seamless process designed for both personal and business use. Whether you're splitting bills with friends, getting paid for freelance work, or accepting payments for your small business, Cash App (owned by Block, Inc.) offers multiple ways to receive money securely. The platform integrates with Square Point of Sale, Square Invoices, and Square Appointments, making it a versatile tool for entrepreneurs. Here’s how it works:

When someone sends you money, it lands directly in your Cash App balance, which you can access instantly. If you prefer, you can link your debit card or bank account (through partners like Sutton Bank or Wells Fargo Bank, N.A.) to transfer funds to your external account. For frequent transactions, enable direct deposit to receive paychecks, gig earnings, or government payments up to two days early. Cash App also supports peer-to-peer payments, so you can request money from contacts or share your unique $Cashtag (a customizable username) for hassle-free transfers.

Security is a top priority—Cash App uses fraud monitoring and fraud prevention tools like PIN protection, biometric login, and transaction alerts. If you encounter issues, their customer support team is available via the app. For businesses, the Square Dashboard provides detailed analytics, and the Square Team can help streamline operations. Compared to competitors like Venmo, Zelle, or Apple Pay, Cash App stands out with its bitcoin trading and stock investing features through Cash App Investing LLC, allowing users to grow their money beyond simple transfers.

Need to receive payments for services? Cash App integrates with Square Invoices, letting you send professional invoices with options for money transfer via credit card or ACH. Freelancers and small business owners can also use Square Appointments to accept bookings and payments in one place. For those dabbling in cryptocurrency, you can even receive bitcoin transactions directly to your Cash App wallet.

Pro tip: If you’re using Cash App for business, consider opening a savings account (offered through partner banks) to separate personal and professional funds. And don’t forget tax filing—Cash App provides annual tax documents for taxable activities like stock sales or bitcoin trades. Whether you’re receiving $5 from a friend or $5,000 from a client, Cash App’s blend of financial services and mobile banking convenience makes it a top choice in 2025.

Example: A freelance graphic designer could set up a $Cashtag like $DesignsByJane, share it with clients, and receive payments within minutes. They could then use the Square Dashboard to track earnings or invest a portion in stocks or bitcoin—all without leaving the app. Meanwhile, a coffee shop owner might use Square Point of Sale to accept Cash App payments alongside Google Pay and other methods, with funds automatically syncing to their Square Team management system.

One thing to watch: While Cash App is user-friendly, always double-check payment details to avoid errors (transactions are instant and often irreversible). For larger sums, consider transferring funds to your external bank for added security. With its robust features and Block, Inc.’s ecosystem, Cash App remains a leader in digital payments this year.

Professional illustration about Dashboard

Cash App Card Benefits

The Cash App Card is one of the most versatile debit cards available in 2025, offering a seamless blend of convenience, security, and financial flexibility. Issued by Sutton Bank in partnership with Block, Inc. (formerly Square), this customizable Visa debit card lets you spend your Cash App balance anywhere Visa is accepted—online, in-store, or at ATMs. Unlike traditional bank cards, the Cash App Card integrates directly with peer-to-peer payments, mobile banking, and even bitcoin transactions, making it a standout choice for modern users.

One of the biggest perks is the direct deposit feature, which allows you to receive paychecks, tax refunds, or government benefits up to two days early. This is a game-changer for freelancers or gig workers who rely on Square Invoices or Square Appointments for income. Plus, with fraud monitoring and instant transaction alerts, you’re always in control of your spending. If your card is lost or stolen, freezing it takes seconds in the app—no need to wait for customer support to intervene.

For small business owners using Square Point of Sale or Square Dashboard, the Cash App Card simplifies expense tracking. Every purchase syncs automatically with your financial services ecosystem, making tax filing a breeze. You can even create unique card designs for team members through Square Team, adding a layer of brand personalization.

Where the Cash App Card truly shines is in its rewards program. Unlike competitors like Venmo or Zelle, Cash App offers Boosts—instant discounts at popular retailers, from coffee shops to grocery stores. For example, activating a Boost might get you 10% off at Whole Foods or $5 off Lyft rides. These savings add up quickly, especially for frequent users.

Investors also benefit, as the card ties into Cash App Investing LLC for stock investing and bitcoin trading. You can instantly convert spare change from purchases into stocks or cryptocurrency, a feature unmatched by Apple Pay or Google Pay. And with Wells Fargo Bank, N.A. handling backend operations, your money is as secure as it is accessible.

Finally, the card supports money transfer and savings account features, letting you set aside funds for goals while still spending flexibly. Whether you’re splitting dinner with friends via Square Cash or managing a side hustle, the Cash App Card is designed to keep up with your dynamic financial life.

Here’s a quick breakdown of key benefits:

- Early direct deposit: Get paid faster than traditional banks.

- Boosts: Exclusive discounts at major retailers.

- Seamless integration: Works with Square products and cryptocurrency services.

- Fraud prevention: Real-time alerts and easy card freezing.

- ATM access: Withdraw cash at over 30,000 ATMs nationwide (small fee applies for out-of-network ATMs).

In a market crowded with digital wallets and payment apps, the Cash App Card stands out by combining everyday usability with advanced financial services. Whether you’re a casual spender, an investor, or a business owner, it’s a tool built to adapt to your needs in 2025.

Professional illustration about Square

Cash App Investing Options

Cash App Investing Options

For users looking to grow their money beyond peer-to-peer payments, Cash App Investing LLC (a subsidiary of Block, Inc.) offers a streamlined way to dive into the stock market and bitcoin trading. Unlike traditional brokerages, Cash App’s investing features are designed for beginners, with a simple interface that lets you buy fractional shares or cryptocurrency with as little as $1. Whether you’re interested in blue-chip stocks or exploring Bitcoin transactions, the platform integrates seamlessly with your existing Cash App balance or linked debit card.

One standout feature is automated investing, where you can set up recurring purchases of stocks or Bitcoin—perfect for dollar-cost averaging. For example, you could schedule $10 weekly investments into Tesla or Bitcoin, building your portfolio passively. The app also provides basic analytics, like historical performance charts, though advanced traders might find the tools limited compared to dedicated platforms like Robinhood or Fidelity.

Security is a priority, with fraud monitoring and two-factor authentication (2FA) to protect your assets. Cash App Investing LLC partners with Sutton Bank and Wells Fargo Bank, N.A. to custody funds, ensuring FDIC insurance up to $250,000 for cash balances (though this doesn’t cover investments). For tax filing, the app generates IRS Form 1099-B for taxable events, but users should consult a tax professional for complex scenarios, especially with cryptocurrency gains.

How does it stack up against competitors? While Venmo and Zelle focus solely on money transfers, and Apple Pay or Google Pay lack investing features, Cash App bridges the gap between mobile banking and wealth-building. However, it’s worth noting that Cash App doesn’t offer mutual funds, ETFs, or retirement accounts—so if you’re planning long-term strategies like IRAs, you’ll need a supplemental platform.

For small business owners using Square Point of Sale or Square Invoices, integrating Cash App investing could be a smart way to allocate surplus revenue. Imagine accepting payments via Square Dashboard and automatically diverting a percentage into stocks or Bitcoin. The Square Team even offers resources (like webinars) to educate entrepreneurs on balancing business finances with personal investing.

Pro tip: If you’re new to stock investing, start with Cash App’s "Discover" tab, which highlights trending companies and educational snippets. And always enable fraud prevention alerts to monitor unusual activity. While the platform is user-friendly, remember that all investments carry risk—diversify beyond Cash App to mitigate exposure.

Finally, don’t overlook the social aspect. Cash App lets you gift stocks or Bitcoin to friends, a unique twist on peer-to-peer payments. Whether you’re splitting a pizza bill or celebrating a milestone, sending $5 in Starbucks shares (instead of cash) adds a fun, financial-literacy angle to gifting.

Note: As of 2025, Cash App doesn’t support savings accounts or bonds—so pair it with a high-yield savings account elsewhere for a balanced approach.

Professional illustration about Square

Cash App Bitcoin Features

Cash App Bitcoin Features: A Deep Dive into Seamless Crypto Transactions

Cash App, developed by Block, Inc. (formerly Square), has become a powerhouse in mobile banking by integrating bitcoin trading directly into its platform. Unlike traditional peer-to-peer payments services like Venmo or Zelle, Cash App lets users buy, sell, and hold bitcoin with just a few taps. The process is streamlined—link your debit card or direct deposit, and you’re ready to invest in cryptocurrency without needing a separate exchange account. One standout feature is the ability to auto-invest spare change from transactions into bitcoin, making micro-investing effortless.

Security is a top priority, with fraud monitoring and fraud prevention tools like biometric login and instant transaction alerts. Cash App also partners with Sutton Bank and Wells Fargo Bank, N.A. to ensure secure transfers. For tax purposes, users receive IRS-compliant forms for bitcoin transactions, simplifying tax filing. The app’s integration with Square Point of Sale and Square Dashboard means small businesses can accept bitcoin payments alongside traditional methods, bridging the gap between crypto and commerce.

Compared to Apple Pay or Google Pay, Cash App’s bitcoin trading is more robust, offering real-time price charts and customizable buy/sell orders. However, it lacks the merchant ubiquity of Square Invoices or Square Appointments. The Cash App Investing LLC arm further expands functionality, allowing users to trade stocks and bitcoin in one place. While fees are competitive, they’re slightly higher than dedicated crypto exchanges—a trade-off for convenience.

For those new to cryptocurrency, Cash App’s customer support provides guides on avoiding scams, like fake money transfer requests. The app also supports bitcoin withdrawals to external wallets, a feature not always found in competitor apps. Whether you’re using it for mobile banking, stock investing, or crypto, Cash App’s bitcoin features cater to both beginners and seasoned traders. Just remember: volatility is real, so never invest more than you can afford to lose.

Pro tip: Enable notifications for price swings to capitalize on bitcoin transactions without constant monitoring. And if you’re a freelancer, link your Square Team account to receive payments in bitcoin, then convert to USD instantly for savings account deposits.

Professional illustration about Investing

Cash App Direct Deposit

Cash App Direct Deposit is one of the most convenient features offered by Block, Inc. (formerly Square), allowing users to receive paychecks, tax refunds, and other payments directly into their Cash App balance. With partnerships with Sutton Bank and Wells Fargo Bank, N.A., Cash App ensures secure and fast transfers, often making funds available up to two days earlier than traditional banks. Whether you're a freelancer using Square Invoices, a small business owner relying on Square Point of Sale, or an employee receiving a paycheck, setting up direct deposit is straightforward—just share your Cash App routing and account numbers with your employer or payer.

One of the standout benefits of Cash App direct deposit is its seamless integration with other financial tools. For instance, if you use Square Dashboard to manage your business finances, your earnings can automatically flow into your Cash App balance, eliminating the need for manual transfers. Similarly, freelancers who rely on Square Appointments or Square Team for scheduling and payroll can streamline their income distribution. Unlike competitors like Venmo, Zelle, or Apple Pay, Cash App doesn’t charge fees for direct deposits, making it a cost-effective choice for both personal and business use.

Security is another major advantage. Cash App employs fraud monitoring and fraud prevention measures, including encryption and instant notifications for transactions. If you’ve linked your Cash App debit card, you can spend your direct deposit funds immediately without waiting for a bank transfer. For those interested in stock investing or bitcoin trading, direct deposit funds can be easily allocated to Cash App Investing LLC or used for bitcoin transactions, all within the same app. Plus, Cash App’s customer support team is available to assist with any issues, whether it’s a delayed deposit or a question about tax filing.

Here’s a pro tip: If you’re using Cash App for peer-to-peer payments or money transfer, enabling direct deposit can help you avoid transfer limits and delays. For example, if you frequently receive payments from clients via Google Pay or other platforms, consolidating those funds through Cash App direct deposit can simplify your finances. Additionally, Cash App now offers a savings account feature, allowing you to earn interest on your direct deposit funds—a perk not commonly found with other mobile banking apps.

To set up direct deposit, navigate to the Banking tab in Cash App, select "Direct Deposit," and provide your employer with the generated account and routing numbers. Keep in mind that some employers or payers may require a voided check or additional verification. Once activated, you’ll enjoy the flexibility of accessing your money faster, whether you’re paying bills, investing in cryptocurrency, or simply managing day-to-day expenses. With its robust features and user-friendly design, Cash App direct deposit is a game-changer for modern financial management.

Professional illustration about Sutton

Cash App Fees Explained

Here’s a detailed, SEO-optimized paragraph on Cash App Fees Explained in conversational American English:

Cash App fees can be confusing, but understanding them helps you avoid surprises. For peer-to-peer payments, sending money from your Cash App balance or linked debit card is free, but using a credit card incurs a 3% fee. Instant transfers (arriving in seconds) cost 0.5%–1.75% (minimum $0.25), while standard bank transfers (1–3 business days) are free. Cash App Investing LLC charges no commissions for stock or Bitcoin trades, but spreads (the difference between buy/sell prices) apply. For Bitcoin transactions, fees vary based on network congestion and are displayed before confirming.

If you use the Cash App debit card (powered by Sutton Bank or Wells Fargo Bank, N.A.), ATM withdrawals cost $2.50 unless you enable direct deposit (which waives fees at in-network ATMs). Businesses using Square Point of Sale or Square Invoices pay processing fees (2.6% + $0.10 per swipe/dip/tap for cards). Unlike Venmo or Zelle, Cash App doesn’t charge for mobile check deposits, but checks can take up to 10 days to clear.

Fraud prevention features like mandatory PINs or Face ID help avoid unauthorized transactions, but disputed payments may take weeks to resolve. For tax filing, Cash App provides free 1099-B forms for crypto gains, but consult a pro for complex cases. Pro tip: Enable fraud monitoring alerts in settings to track unusual activity. While competitors like Apple Pay or Google Pay focus on seamless checkout, Cash App’s strength lies in its hybrid model—combining money transfer, savings account tools, and cryptocurrency access with transparent (if occasionally quirky) pricing.

This paragraph integrates key entities and LSI terms naturally while avoiding repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Wells

Cash App Customer Support

If you're using Cash App for peer-to-peer payments, bitcoin trading, or even managing direct deposits, knowing how to reach Cash App customer support is crucial—especially if you encounter issues like unauthorized transactions or delays with your debit card. Owned by Block, Inc. (formerly Square), Cash App offers multiple support channels, but navigating them efficiently can save you time. Here’s how to get help in 2025:

In-App Support is the fastest way to resolve most issues. Open the app, tap your profile icon, scroll to "Support," and describe your problem—whether it’s fraud monitoring alerts, failed money transfers, or questions about tax filing for stock investing or cryptocurrency activities. The support team typically responds within 24 hours. For urgent matters like a compromised account, use the "Report a Payment Issue" feature under the transaction in question.

If you prefer phone support, Cash App now offers limited live-agent assistance at +1 (800) 969-1940, though wait times can vary. Pro tip: Have your Cashtag (username) and linked email/phone ready to verify your identity. Note that Square Point of Sale, Square Invoices, and other Square Dashboard services have separate support lines, so don’t confuse them with Cash App’s dedicated team.

For banking-related issues—like problems with your Cash App Investing LLC account or disputes involving Sutton Bank or Wells Fargo Bank, N.A. (which handle Cash App’s banking services)—you may need to escalate to the Cash App dispute team. They handle fraud prevention claims, including unauthorized debit card charges or errors with direct deposits. Documentation is key: Screenshot transaction details, error messages, and any communication with recipients (e.g., if you accidentally paid the wrong person).

Comparing Cash App to competitors like Venmo, Zelle, or Apple Pay, its support system is more self-service but integrates financial services like mobile banking and savings accounts seamlessly. One unique feature? Cash App’s Square Team monitors suspicious bitcoin transactions proactively and may freeze accounts if fraud monitoring flags unusual activity. If this happens, respond promptly to their email requests for verification.

For tax filing questions—say, if you traded Bitcoin or stocks via Cash App Investing LLC—the app generates IRS forms (like 1099-B) automatically. You can access these under the "Documents" tab. If you’re missing a form, contact support before the April deadline to avoid penalties.

Lastly, scams are rampant in peer-to-peer payment apps. Cash App will never ask for your PIN or password via email, phone, or social media. If you’re pressured to "verify" your account by a caller claiming to be from support, it’s a scam—report it immediately through the app’s "Contact Us" flow.

Proactive steps to avoid needing support: Enable two-factor authentication, link only trusted bank accounts, and double-check Cashtags before sending money. If you’re a freelancer using Square Appointments or Square Invoices, keep business transactions separate from personal Cash App use to simplify record-keeping.

Professional illustration about Venmo

Cash App vs Competitors

When comparing Cash App to its top competitors like Venmo, Apple Pay, Zelle, and Google Pay, it’s clear that each platform has unique strengths tailored to different financial needs. Cash App, developed by Block, Inc. (formerly Square), stands out with its all-in-one financial services approach, offering peer-to-peer payments, direct deposit, a debit card (Cash Card), and even bitcoin trading and stock investing through Cash App Investing LLC. Unlike Venmo, which focuses heavily on social payments and splitting bills, Cash App provides more robust money transfer options, including instant deposits (for a small fee) and the ability to buy and sell cryptocurrency—a feature Venmo only recently added but with fewer trading options.

One area where Cash App excels is integration with Square’s ecosystem, including Square Point of Sale, Square Invoices, and Square Appointments, making it a favorite for freelancers and small businesses. For example, a hair stylist using Square Appointments can seamlessly accept payments through Cash App, while Square Dashboard provides real-time analytics—something competitors like Zelle or Apple Pay don’t offer. However, Zelle dominates in bank-to-bank transfers, as it’s directly embedded into many major banking apps (like Wells Fargo Bank, N.A.), offering faster, fee-free transfers between enrolled users. Meanwhile, Apple Pay and Google Pay prioritize convenience for in-store and online purchases, leveraging NFC technology, whereas Cash App’s debit card requires physical or digital use at merchants.

Fraud prevention is another critical differentiator. Cash App employs advanced fraud monitoring tools and allows users to enable security locks, but it’s often criticized for slower customer support compared to Venmo’s dispute resolution system. On the flip side, Cash App’s tax filing feature for Bitcoin transactions simplifies crypto reporting—a pain point for users on other platforms. For those looking to grow savings, Cash App’s savings account (partnered with Sutton Bank) offers competitive APY, though Google Pay and Apple Pay have begun rolling out similar high-yield savings options in 2025.

Here’s a quick breakdown of key features:

- Peer-to-peer payments: Cash App and Venmo lead, but Zelle wins for speed (when both users are enrolled).

- Cryptocurrency: Cash App offers Bitcoin trading, while Venmo and PayPal support multiple coins. Apple Pay and Google Pay avoid crypto entirely.

- Business tools: Cash App’s tie-in with Square Team and invoicing tools gives it an edge for entrepreneurs.

- User experience: Venmo’s social feed appeals to younger users, while Cash App’s minimalist design focuses on functionality.

Ultimately, choosing between Cash App and its competitors depends on your priorities. If you’re into bitcoin transactions, investing, or running a small business, Cash App is hard to beat. But for everyday mobile banking with friends or instant bank transfers, Venmo or Zelle might suit you better. Meanwhile, Apple Pay and Google Pay remain kings of contactless payments, though they lack the broader financial services ecosystem Cash App provides.

Professional illustration about Apple

Cash App for Small Business

Cash App for Small Business

For small business owners looking for a streamlined way to handle payments, Cash App (owned by Block, Inc.) offers a versatile solution that goes beyond simple peer-to-peer payments. Unlike traditional banking systems, Cash App provides tools tailored for entrepreneurs, including Square Point of Sale, Square Invoices, and Square Appointments—all integrated into a single platform. This makes it easy to accept payments, schedule services, and manage finances without juggling multiple apps.

One of the biggest advantages of using Cash App for business is its seamless integration with Square Dashboard, where owners can track sales, inventory, and customer data in real time. The Square Team feature also allows you to delegate tasks, such as refunds or shift management, while maintaining control over permissions. For businesses that operate both online and in-person, Cash App’s debit card (powered by Sutton Bank or Wells Fargo Bank, N.A.) lets you spend earnings instantly or withdraw funds from ATMs—no waiting for bank transfers.

When it comes to money transfer options, Cash App stands out with its low fees compared to competitors like Venmo, Zelle, or Google Pay. For example, sending or receiving money between Cash App users is free, while instant transfers to external banks cost just 1.5%—a fraction of what some mobile banking services charge. Small businesses can also enable direct deposit for employees or contractors, making payroll simpler and faster.

Security is another strong suit. Cash App’s fraud monitoring and fraud prevention tools include instant notifications for suspicious activity and the ability to freeze your card via the app. Plus, the platform’s customer support team is available 24/7 to resolve issues, which is crucial for businesses that can’t afford downtime.

For entrepreneurs interested in diversifying their finances, Cash App offers Cash App Investing LLC for stock investing and bitcoin trading. While not a substitute for a dedicated savings account, these features let businesses allocate spare cash into cryptocurrency or equities with just a few taps. However, it’s worth noting that bitcoin transactions can be volatile, so this is best suited for those comfortable with risk.

Tax season? Cash App simplifies tax filing by generating annual reports of transactions, which can be exported directly to accounting software. This is a game-changer for solopreneurs or freelancers who need to track deductible expenses.

In summary, Cash App is more than just a peer-to-peer payments app—it’s a robust financial services hub for small businesses. Whether you’re a coffee shop using Square Point of Sale, a freelancer sending Square Invoices, or a startup exploring stock investing, Cash App’s ecosystem is designed to save time and reduce friction in managing money. Just remember to compare its features with alternatives like Apple Pay or Zelle to ensure it aligns with your business needs.

Professional illustration about Zelle

Cash App Promo Codes 2025

Looking for Cash App promo codes in 2025? You’re in the right place. Cash App, owned by Block, Inc. (formerly Square), continues to offer limited-time promotions to attract new users and reward existing ones. These promo codes can unlock perks like cash bonuses, fee-free peer-to-peer payments, or even discounts when using Square Point of Sale or Square Invoices for business transactions. For example, entering a 2025 promo code during sign-up might net you a $5–$20 bonus when you link your debit card or set up direct deposit.

One of the most appealing aspects of Cash App’s promotions is how they integrate with the platform’s broader financial services. Whether you’re using Cash App Investing LLC for stock investing or dabbling in bitcoin trading, promo codes can sometimes apply to these features too. Keep an eye out for seasonal deals—Black Friday and New Year’s often bring exclusive offers. Just remember: promo codes are typically case-sensitive and expire quickly, so double-check the terms before applying them.

How do you find legit Cash App promo codes in 2025? Start by checking Cash App’s official social media channels or the Square Dashboard for announcements. Scammers often fake these codes, so never share your login details to “unlock” a deal. Legitimate promotions will only ask you to enter the code in the app’s “Promotions” tab. Also, compare Cash App’s offers with competitors like Venmo, Zelle, or Apple Pay—sometimes, switching incentives are more lucrative elsewhere.

For small businesses using Square Team tools, promo codes might apply to Square Appointments or Square Invoices, reducing processing fees. If you’re a freelancer, stacking a promo code with tax filing features could save you money during tax season. And don’t forget about fraud prevention: Cash App’s customer support team will never ask for a promo code to resolve issues, so stay vigilant against phishing attempts.

Finally, if you’re using Cash App’s debit card (powered by Sutton Bank or Wells Fargo Bank, N.A.), some promo codes offer cashback on purchases. Linking the card to Google Pay might unlock additional rewards. Since mobile banking is more competitive than ever in 2025, these small perks can add up—just be sure to read the fine print on withdrawal limits or money transfer fees. Whether you’re into cryptocurrency, peer-to-peer payments, or just want a savings account alternative, Cash App’s 2025 promo codes are worth exploring.

Professional illustration about Google

Cash App Safety Tips

Keeping Your Cash App Secure in 2025

With over 50 million active users, Cash App (owned by Block, Inc.) remains one of the most popular peer-to-peer payment apps in 2025. However, as digital transactions grow, so do security risks. Here’s how to protect your account and money while using Cash App for money transfers, bitcoin trading, or everyday spending.

1. Enable All Security Features

Cash App offers multiple layers of protection, but you need to activate them:

- Two-Factor Authentication (2FA): Always turn this on in settings. It adds an extra step (like a text or email code) when logging in.

- Face ID/Touch ID: For mobile users, biometric login prevents unauthorized access if your phone is lost.

- Cash App Card Controls: If you use the debit card, toggle notifications for every transaction. Freeze the card instantly if you notice suspicious activity.

2. Recognize and Avoid Scams

Fraudsters constantly evolve their tactics. Common Cash App scams in 2025 include:

- Phishing: Fake emails/texts pretending to be from Cash App Support (real support will never ask for your PIN or login details).

- Payment Flip Scams: Strangers offering "instant money doubling" if you send them funds first (this is always a lie).

- Fake Investment Promises: Be wary of unsolicited advice about Cash App Investing LLC or bitcoin transactions. Only use official channels.

3. Link Trusted Banks and Cards

Cash App partners with Sutton Bank and Wells Fargo Bank, N.A. for banking services. To minimize risks:

- Only link accounts you actively use. Avoid adding cards from lesser-known banks.

- If you use direct deposit, verify the account details multiple times. A typo could send your paycheck to the wrong person.

- Regularly review linked devices under settings. Remove old phones or tablets you no longer use.

4. Monitor Transactions Daily

Open the app frequently to check your balance and activity. Unlike Venmo or Zelle, Cash App doesn’t offer a dedicated "dispute" button for unauthorized payments. If you spot fraud:

- Cancel pending payments immediately (tap the transaction > … > Refund).

- Dispute completed charges via the app’s support chat.

- Report scams to Cash App and your bank within 24 hours for the best chance of recovery.

5. Use Cash App for the Right Purposes

Cash App isn’t ideal for every transaction. For example:

- Large Transfers: Services like Google Pay or Apple Pay may offer better buyer/seller protections for big purchases.

- Business Payments: Freelancers should consider Square Invoices or Square Point of Sale for invoicing, as they provide dispute resolution.

- Savings: While Cash App offers a savings account feature, traditional banks often provide higher interest rates and FDIC insurance.

6. Secure Your Bitcoin and Investments

If you trade cryptocurrency or stocks through Cash App:

- Never share your Bitcoin wallet QR code publicly. Scammers can drain funds instantly.

- Enable "Require PIN for Selling" in the investing settings to prevent accidental trades.

- For tax filing, export your transaction history early—Cash App’s reports can take days to generate during peak seasons.

7. Know How Cash App Differs From Competitors

While Cash App, Venmo, and Zelle all facilitate peer-to-peer payments, Cash App’s flexibility (e.g., stock investing, BTC trading) makes it a bigger target for fraud. Unlike Square Dashboard (used by businesses), Cash App lacks detailed fraud monitoring tools for individuals. Staying proactive is key.

Final Tip: Always update the app. In 2025, Block, Inc. releases security patches monthly. Outdated versions might miss critical fraud prevention updates. If something feels off—like a payment request from a "friend" you don’t recognize—pause and verify before sending money. Your vigilance is the best defense.

Frequently Asked Questions

What is the downside to using Cash App?

Cash App has some limitations compared to traditional banking. It lacks FDIC insurance for investments and has transaction limits. Key downsides include:

- No physical branches for in-person support

- Fees for instant transfers (1.5% per transaction)

- Potential for scams due to peer-to-peer nature

How do I borrow $200 from Cash App?

Cash App Borrow allows eligible users to take short-term loans up to $200. First, check if you see the 'Borrow' option in the app. Requirements include:

- Maintain regular Cash App deposits

- Have a good transaction history

- Be at least 18 years old with a verified account

How much does Cash App charge per $100?

Cash App charges vary by transaction type. Standard transfers are free, but instant transfers cost 1.5%. For $100:

- Instant transfer fee: $1.50

- Business transactions: 2.75%

- ATM withdrawals: $2.50 after free monthly limit

Do you need a bank account for Cash App?

No, you can use Cash App without a bank account, but functionality is limited. You'll need:

- A linked debit card for adding funds

- To receive payments via your $Cashtag

- To use the Cash Card for purchases/withdrawals

Can someone access your bank account through Cash App?

Direct bank account access isn't possible through Cash App alone. However, security risks exist:

- Never share your login PIN or $Cashtag

- Enable two-factor authentication

- Only transact with trusted contacts

What is the $600 rule on Cash App?

The IRS requires Cash App to report users receiving $600+ annually for goods/services. This means:

- You'll receive a 1099-K form

- Applies to business transactions only

- Personal payments aren't counted

How does Cash App compare to Venmo?

Cash App and Venmo both offer P2P payments but differ in features. Cash App provides:

- Bitcoin and stock investing

- Higher instant transfer limits

- Built-in tax reporting tools

Can you use Cash App internationally?

Cash App works primarily in the US and UK. Key restrictions:

- US accounts can't send to UK users

- Currency conversion fees apply

- Cash Card only works in issuing country

How do I avoid Cash App scams?

Stay safe by following these practices:

- Never share your sign-in code

- Verify recipient details before sending

- Only use official support channels

What banks work with Cash App?

Cash App partners with Sutton Bank and Wells Fargo. Key banking features include:

- FDIC insurance up to $250,000

- Direct deposit routing numbers

- Instant transfers to supported banks