Investing in Gold Coins is a smart way to diversify your portfolio and protect your wealth in 2025. Whether you're looking for premium bullion from the Perth Mint or iconic Krugerrands from the South African Mint, this guide covers 5 essential steps to make informed decisions. Learn how to evaluate purity, weight, and authenticity while comparing prices from trusted dealers. We'll also explore storage options and market trends to maximize your returns. Start building your precious metals collection today with confidence.

Professional illustration about Perth

Gold Coin Types 2025

Gold Coin Types 2025: A Comprehensive Guide for Investors and Collectors

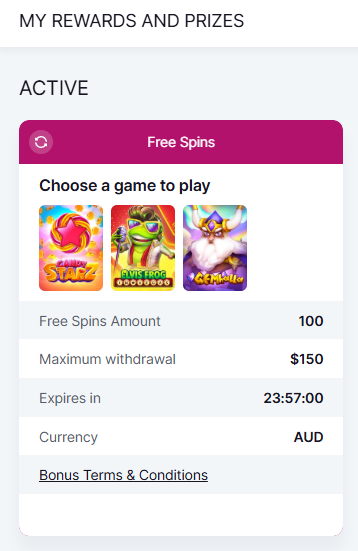

In 2025, gold coins remain one of the most sought-after forms of wealth protection and precious metals investment. Whether you're a seasoned collector or a first-time buyer, understanding the different gold coin types available today is crucial. Leading mints like the Perth Mint, Royal Canadian Mint, and United States Mint continue to produce high-quality gold bullion coins, each with unique designs, purity standards, and historical significance.

Popular Gold Bullion Coins in 2025

- American Gold Eagle: Produced by the US Mint, this iconic coin contains 22-karat gold (91.67% purity) and features Augustus Saint-Gaudens’ Liberty design. Its popularity stems from its recognizable status and government-backed guarantee.

- Canadian Gold Maple Leaf: Known for its 99.99% purity, the Royal Canadian Mint's flagship coin is a favorite among investors prioritizing gold purity. The 2025 edition showcases advanced security features, including micro-engraved radial lines.

- South African Gold Krugerrand: As the first modern gold bullion coin, the Krugerrand (22-karat gold) remains a staple for those looking to diversify their portfolios. Its value closely tracks the gold spot price, making it a practical choice.

- Chinese Gold Panda: The Chinese Mint updates its panda design annually, and the 2025 version continues this tradition with intricate artwork. These coins (99.9% pure gold) are highly collectible due to their limited mintage.

- Mexican Gold Libertad: Struck by the Mexican Mint, the Libertad is prized for its stunning depiction of Winged Victory and high gold purity (99.9%). Its limited supply often commands higher gold premiums.

- Austrian Gold Philharmonic: Celebrating Vienna’s musical heritage, this 99.99% pure coin from the Austrian Mint appeals to both music lovers and investors. Its elegant design and affordability make it a standout.

Factors to Consider When Choosing Gold Coins

When evaluating gold coin types, consider the following:

1. Purity and Weight: Most gold bullion coins range from 1/10 oz to 1 oz, with purities between 91.67% (22-karat) and 99.99% (24-karat). Higher purity often means softer coins, so durability matters for frequent handling.

2. Design and Collectibility: Coins like the Chinese Gold Panda or Mexican Gold Libertad gain value from their annual design changes, while classics like the Gold Krugerrand are valued for their historical roots.

3. Premiums Over Spot Price: Government-minted coins typically carry higher gold premiums due to their authenticity guarantees, but private mints or secondary markets may offer lower costs.

4. Liquidity: Widely recognized coins like the American Gold Eagle or Canadian Gold Maple Leaf are easier to sell quickly, especially during market fluctuations.

Why Gold Coins Remain a Smart Investment in 2025

With economic uncertainties persisting, gold investment offers a tangible hedge against inflation and currency devaluation. The gold spot price in 2025 continues to attract both institutional and individual buyers, reinforcing the metal’s role in wealth protection. Additionally, the artistry and craftsmanship behind coins from the Perth Mint or South African Mint add an extra layer of appeal for numismatists.

Whether you prioritize liquidity, purity, or aesthetic value, the 2025 lineup of gold coins provides options for every investor. Always verify authenticity by purchasing from reputable dealers or directly from mints to avoid counterfeit risks. By aligning your choices with your financial goals, you can build a diversified precious metals portfolio that stands the test of time.

Professional illustration about Coins

Investing in Gold Coins

Investing in gold coins is one of the most reliable ways to diversify your portfolio and protect your wealth against economic uncertainty. In 2025, gold remains a cornerstone of precious metals investing, with gold bullion coins from trusted mints like the Perth Mint, Royal Canadian Mint, and United States Mint leading the market. These coins are not just collectibles—they’re tangible assets tied to the gold spot price, making them a smart choice for both new and seasoned investors.

When choosing gold coins, purity and design matter. For example, the American Gold Eagle and Canadian Gold Maple Leaf are among the most popular options, boasting gold purity of 91.67% and 99.99%, respectively. The South African Gold Krugerrand, another heavyweight in the industry, contains 22-karat gold, while the Chinese Gold Panda and Mexican Gold Libertad are prized for their intricate designs and high gold premiums. Each mint has its own reputation—US Mint coins are backed by the U.S. government, while the Austrian Gold Philharmonic is celebrated for its cultural significance and flawless craftsmanship.

Here’s what to consider before buying:

- Gold coin purity: Higher purity (like 24-karat) often means higher value, but some investors prefer 22-karat coins like the Gold Krugerrand for durability.

- Gold premiums: Coins from mints like the Perth Mint or South African Mint may carry higher premiums due to their collectible status.

- Liquidity: Widely recognized coins like the Gold American Eagle are easier to sell quickly compared to niche options.

- Storage: Unlike gold bullion bars, coins are compact and easier to store securely.

For those new to gold investment, starting with government-minted coins is a safe bet. The Royal Canadian Mint’s Canadian Gold Maple Leaf, for instance, is highly liquid and often traded close to the gold spot price. Meanwhile, the American Gold Eagle remains a top pick for U.S. investors due to its legal tender status and widespread recognition. If you’re looking for something unique, the Chinese Gold Panda changes its design annually, adding a collectible element to your wealth protection strategy.

Timing is also key. While gold prices fluctuate, historical trends show that gold bullion coins tend to hold their value over time, especially during inflation or market downturns. In 2025, experts recommend keeping an eye on the gold spot price and buying during dips to maximize returns. Whether you’re stacking Gold Krugerrands or diversifying with Mexican Gold Libertads, the goal is to build a balanced portfolio that withstands economic shifts.

Finally, don’t overlook the importance of authenticity. Always purchase from reputable dealers or directly from mints like the US Mint or Perth Mint to avoid counterfeits. Certificates of authenticity and original packaging can further ensure your investment’s value. With the right strategy, investing in gold coins can be a rewarding way to safeguard your financial future.

Professional illustration about African

Best Gold Coins to Buy

When it comes to gold investment, choosing the best gold coins to buy depends on factors like gold purity, gold premiums, and the reputation of the issuing gold mints. Among the most sought-after options in 2025 are the American Gold Eagle (produced by the United States Mint) and the Canadian Gold Maple Leaf (minted by the Royal Canadian Mint). The Gold American Eagle is a favorite for its .9167 purity (22-karat gold) and iconic Lady Liberty design, backed by the US Mint's guarantee. Meanwhile, the Canadian Gold Maple Leaf boasts .9999 purity (24-karat gold), making it one of the purest gold bullion coins available.

For collectors and investors seeking diversity, the Chinese Gold Panda and Mexican Gold Libertad offer unique designs that change annually, adding aesthetic appeal to their intrinsic value. The Austrian Gold Philharmonic, minted by the Austrian Mint, is another top choice, especially for European investors, with its .9999 purity and tribute to classical music. If you're looking for historic significance, the South African Gold Krugerrand (from the South African Mint) is the original modern gold bullion coin, first introduced in 1967. Its .9167 purity and recognizable springbok design make it a staple in wealth protection strategies.

Premiums vary depending on the coin’s rarity, gold spot price, and minting costs. For example, the Perth Mint's gold coins, like the Australian Kangaroo, often carry slightly higher premiums due to their intricate designs and limited editions. On the other hand, the Gold Krugerrand typically has lower premiums, making it an accessible entry point for new investors. When evaluating gold coin purity, always check the mint’s certification—reputable mints like the Royal Canadian Mint and US Mint provide assay certificates for authenticity.

For those prioritizing liquidity, Gold American Eagles and Canadian Gold Maple Leafs are widely recognized and easy to trade globally. Smaller denominations (e.g., 1/10 oz or 1/4 oz coins) can be more affordable but may carry higher premiums per ounce compared to 1 oz coins. If you're diversifying into precious metals, consider mixing government-minted coins like the American Gold Eagle with privately minted gold bars to balance premiums and flexibility.

Ultimately, the best gold coins to buy align with your financial goals—whether it’s wealth protection, portfolio diversification, or collecting rare designs. Keep an eye on gold bullion market trends and mint releases, as limited-edition coins (like annual Chinese Gold Pandas) can appreciate beyond their metal value. Stick with trusted mints, verify gold bar purity if branching into bars, and always compare premiums to maximize your investment.

Professional illustration about American

Gold Coin Purity Guide

When it comes to gold investment, understanding gold coin purity is non-negotiable. The gold spot price might grab headlines, but the actual value of your gold bullion coins hinges on their fineness—measured in karats or as a percentage. Most government-backed gold coins, like the American Gold Eagle (91.67% pure, or 22-karat) or the South African Gold Krugerrand (also 22-karat), strike a balance between purity and durability. These coins blend gold with alloys like copper or silver to withstand handling, making them ideal for both wealth protection and circulation.

For purists, the Royal Canadian Mint’s Canadian Gold Maple Leaf and the Perth Mint’s offerings stand out with 99.99% purity (24-karat). Their brilliance and softer composition appeal to collectors, though they require careful storage. Meanwhile, the Chinese Gold Panda and Mexican Gold Libertad fluctuate in purity year-to-year, so always check the latest specs—especially in 2025, as mints occasionally tweak formulas. The Austrian Gold Philharmonic mirrors the Maple Leaf’s 24-karat standard, catering to European markets.

Gold premiums often reflect purity. Higher-karat coins like the Canadian Gold Maple Leaf command steeper premiums due to refining costs, while 22-karat options like the Gold Krugerrand trade closer to gold spot price. But purity isn’t the only factor—designs matter too. The US Mint’s Gold American Eagle, for instance, pairs its 22-karat content with iconic Lady Liberty imagery, boosting its numismatic appeal.

Pro tip: Always verify purity markings. Reputable mints like the United States Mint or South African Mint stamp each coin’s fineness (e.g., “.9999” for 24-karat). Avoid vague terms like “pure gold”—actual metrics matter. And remember, gold bar purity follows similar rules, but coins offer added liquidity and recognizability. Whether you’re eyeing the Perth Mint’s lunar series or the Austrian Gold Philharmonic, purity is your compass in the precious metals market.

Storage also plays a role. While 24-karat coins like the Canadian Gold Maple Leaf are stunning, their softness means capsules or velvet-lined cases are a must. For active traders, 22-karat coins like the American Gold Eagle withstand more handling. Bottom line: Match purity to your goals—long-term wealth protection favors higher purity, while frequent traders might prioritize durability.

Finally, watch for regional trends. In 2025, Asian markets increasingly favor 24-karat gold coins like the Chinese Gold Panda, while European investors lean toward the Austrian Gold Philharmonic. North America? The Gold American Eagle and Canadian Gold Maple Leaf dominate. Your ideal pick blends purity, design, and market demand—so research before you buy.

Professional illustration about Bullion

Gold Coin Storage Tips

Proper storage is crucial for protecting your gold coins—whether you own American Gold Eagles, Canadian Gold Maple Leafs, or South African Gold Krugerrands. The right storage method preserves their condition, maintains their gold purity, and safeguards your gold investment from environmental damage or theft. Here’s a breakdown of the best practices for storing gold bullion coins in 2025.

1. Choose the Right Storage Environment

Gold coins are sensitive to humidity, temperature fluctuations, and air pollutants. Ideally, store them in a cool, dry place with stable conditions—think a home safe or a bank safety deposit box. Avoid basements or attics where moisture levels can spike. For added protection, consider using silica gel packets or dehumidifiers to control moisture. High-end gold coins like the Chinese Gold Panda or Austrian Gold Philharmonic often come in protective capsules from mints like the Perth Mint or Royal Canadian Mint—keep them sealed to prevent tarnishing.

2. Use Protective Packaging

Never handle gold bullion coins with bare hands, as oils and acids from your skin can degrade their surfaces over time. Instead, use cotton gloves and store coins in inert materials like Mylar flips, acid-free coin tubes, or archival-quality sleeves. For example, US Mint-issued Gold American Eagles are best kept in their original mint tubes, while Mexican Gold Libertads benefit from airtight capsules. If you’re stacking multiple coins, avoid PVC-based holders, as they can release harmful chemicals that react with the metal.

3. Diversify Storage for Security

Don’t keep all your precious metals in one place. Split your holdings between a home safe, a bank vault, and even a private storage facility specializing in gold bullion. This strategy minimizes risk—if one location is compromised, your entire wealth protection plan isn’t jeopardized. For instance, you might store common Gold Krugerrands in a bank and rarer South African Mint pieces in a high-security home safe. Always document your inventory and consider insuring high-value collections.

4. Stay Discreet and Secure

Avoid discussing your gold coin holdings publicly, and ensure your storage solutions are tamper-proof. Modern safes should be bolted down and rated for both fire and burglary resistance. If using a safety deposit box, verify the bank’s insurance policies—some don’t cover gold bar purity or gold coin designs at full market value. For tech-savvy investors, discreet RFID-blocking bags can prevent electronic theft of tracking-enabled items like Royal Canadian Mint products.

5. Monitor Market Conditions

Storage isn’t just physical—it’s also about timing. Track the gold spot price and gold premiums to decide whether to hold or sell. Coins from mints like the United States Mint or Perth Mint may appreciate differently based on collector demand and gold coin purity (e.g., 24-karat vs. 22-karat). Regularly inspect stored coins for signs of discoloration or corrosion, especially if they’re older or have unique finishes like the Chinese Gold Panda’s matte texture.

By following these gold coin storage tips, you’ll ensure your gold bullion coins retain their value and appeal, whether they’re American Gold Eagles for investment or Austrian Gold Philharmonics for their artistic merit. Always prioritize security, environmental control, and proper handling to maximize your precious metals’ longevity.

Professional illustration about Canadian

Gold Coin Market Trends

The gold coin market in 2025 continues to thrive as investors seek wealth protection amid economic uncertainty, with gold bullion coins remaining a cornerstone of precious metals portfolios. Leading mints like the Perth Mint, Royal Canadian Mint, and US Mint have seen steady demand for flagship products such as the Gold American Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand. One notable trend is the rising popularity of coins with unique gold coin designs and cultural significance, like the Chinese Gold Panda and Mexican Gold Libertad, which appeal to both collectors and investors. The gold spot price volatility in early 2025 has further driven interest in physical gold, with buyers favoring coins over bars due to their liquidity and recognizable gold purity standards.

Premium variations are also influencing the market. For example, the Austrian Gold Philharmonic has gained traction among European investors for its .9999 fine gold content, while the American Gold Eagle maintains its dominance in the U.S. thanks to its 22-karat composition and government backing. Meanwhile, the South African Mint has reintroduced limited-edition Gold Krugerrand finishes, capitalizing on nostalgia and gold coin premiums. Analysts note that gold bullion coins with lower premiums—like the Canadian Gold Maple Leaf—are outperforming in bulk purchases, as institutional buyers prioritize cost efficiency over collectibility.

Another key development is the shift toward smaller denominations. With gold bar weights becoming less accessible to retail investors, mints are expanding 1/10 oz and 1/4 oz options. The Royal Canadian Mint, for instance, reported a 20% increase in sales of fractional Canadian Gold Maple Leafs in Q1 2025, reflecting demand for affordable entry points. Similarly, the Perth Mint has leveraged its reputation for high gold bar purity to launch innovative hybrid products, such as divisible gold coins with detachable segments—a response to the growing preference for flexible gold investment strategies.

Regional trends are equally compelling. In Asia, the Chinese Gold Panda remains a top seller due to its annual design updates and .999 purity, while North American markets lean toward the Gold American Eagle for its liquidity. Europe’s appetite for the Austrian Gold Philharmonic underscores a preference for .9999 fine gold, and Latin American investors are increasingly turning to the Mexican Gold Libertad as a hedge against currency fluctuations. For those monitoring gold premiums, experts recommend comparing mint-specific pricing, as premiums for the Gold Krugerrand can vary significantly by distributor.

Finally, technological advancements are reshaping how gold coins are traded. Blockchain-backed verification systems, now adopted by the Perth Mint and Royal Canadian Mint, provide tamper-proof authenticity certificates—a game-changer for high-net-worth buyers. As gold refineries streamline production, expect more mints to offer customizable gold coin designs or limited-run series to differentiate themselves in a competitive market. Whether you’re a seasoned investor or a first-time buyer, staying informed about these gold coin market trends is crucial for maximizing returns in 2025.

Professional illustration about United

Rare Gold Coins Value

When it comes to rare gold coins value, collectors and investors alike should pay close attention to factors like mintage numbers, historical significance, and gold purity. Coins from prestigious mints such as the Perth Mint, South African Mint, Royal Canadian Mint, and United States Mint often carry higher premiums due to their reputation for quality and limited production runs. For example, the Gold American Eagle and Canadian Gold Maple Leaf are highly sought after not just for their gold bullion content but also for their intricate designs and .9999 fine gold purity. Meanwhile, the South African Gold Krugerrand, one of the oldest modern bullion coins, holds both wealth protection appeal and numismatic value, especially for early-year editions.

The Chinese Gold Panda and Mexican Gold Libertad are other standout examples where rarity drives value. The Chinese Mint frequently updates the Panda’s design annually, making older versions—particularly those with low mintage—extremely desirable. Similarly, the Libertad’s limited release quantities and stunning artwork contribute to its premium over the gold spot price. Even the Austrian Gold Philharmonic, though more widely available, sees spikes in value for special editions or proof versions.

Beyond mintage, gold coin designs and condition play a huge role. A well-preserved American Gold Eagle with full mint luster or a rare Gold Krugerrand with a unique mint error can fetch significantly higher prices than standard bullion coins. Collectors should also consider gold premiums, which vary based on dealer demand and market trends. For instance, coins from the US Mint or Perth Mint often carry higher premiums due to their brand recognition and consistent quality.

For investors focused on precious metals as a hedge, understanding the balance between gold bullion coins and numismatic rarity is key. While standard bullion coins like the Gold Maple Leaf or Gold American Eagle are tied closely to the gold spot price, rare or vintage editions can appreciate independently of market fluctuations. Always verify gold purity (e.g., .9167 for Krugerrands vs. .9999 for Maple Leafs) and buy from reputable sources to avoid counterfeits. Whether you’re diversifying for wealth protection or building a collection, rare gold coins offer a unique blend of tangible asset security and potential long-term appreciation.

Professional illustration about Mint

Gold Coin Grading System

Understanding the gold coin grading system is crucial for investors and collectors looking to maximize the value of their precious metals. Whether you own an American Gold Eagle, a Canadian Gold Maple Leaf, or a South African Gold Krugerrand, knowing how these coins are graded can significantly impact your gold investment strategy. Grading evaluates a coin’s condition based on factors like wear, luster, strike quality, and surface preservation, directly influencing its gold premiums and resale potential.

The most widely recognized grading standard is the Sheldon Scale, which ranges from 1 (Poor) to 70 (Mint State Perfect). For example, a Gold American Eagle graded MS-70 by a reputable service like PCGS or NGC means it’s flawless—no scratches, marks, or imperfections under 5x magnification. Coins in this condition often command higher premiums due to their rarity. On the other hand, a coin graded AU-58 (About Uncirculated) might show slight friction on high points but retains most of its original luster, making it a more affordable option for investors focused on wealth protection rather than numismatic value.

Different gold mints produce coins with varying levels of detail and gold purity, which can affect grading outcomes. For instance, the Royal Canadian Mint’s Gold Maple Leaf is known for its intricate maple leaf design and 99.99% purity, making it highly sought after in high-grade conditions. Meanwhile, the Perth Mint’s coins, like the Australian Kangaroo, often feature stunning designs that appeal to collectors, but their finish (e.g., proof vs. bullion) can influence grading. Proof coins, with their mirror-like fields and frosted designs, are typically graded more strictly than standard gold bullion coins.

When submitting coins for grading, consider the following tips:

- Cleanliness matters: Never clean your coins, as this can damage surfaces and lower their grade. Even a well-intentioned wipe can leave micro-scratches.

- Storage is key: Use airtight capsules or holders to prevent toning or environmental damage, especially for coins like the Chinese Gold Panda or Mexican Gold Libertad, which are prized for their artistry.

- Buy graded coins for certainty: If you’re new to gold coin investing, purchasing already-graded coins from trusted dealers eliminates guesswork about condition and authenticity.

Grading also plays a role in gold spot price calculations. While bullion coins like the Austrian Gold Philharmonic are valued primarily for their metal content, higher grades can add collectible value. For example, a US Mint-issued Gold American Eagle in MS-69 might trade for slightly above spot, while an MS-70 could fetch a 10–20% premium. This distinction is vital for investors balancing gold bullion affordability with potential appreciation.

Finally, remember that grading isn’t just for rare coins. Even modern releases from the South African Mint or Perth Mint can benefit from certification, especially if you plan to sell later. A Gold Krugerrand graded MS-65 or higher will likely outperform raw (ungraded) coins in the secondary market. By mastering the grading system, you’ll make smarter decisions—whether you’re stacking gold bars or building a diverse coin portfolio.

Professional illustration about American

Gold Coin vs Bullion

When deciding between gold coins and gold bullion, investors need to consider factors like gold premiums, liquidity, and wealth protection strategies. Gold coins, such as the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand, are minted by government-backed institutions like the US Mint, Royal Canadian Mint, and South African Mint. These coins often carry higher premiums over the gold spot price due to their intricate gold coin designs, legal tender status, and collectible appeal. For example, the Gold American Eagle contains 91.67% gold purity (22-karat) with added durability from silver and copper alloys, while the Canadian Gold Maple Leaf boasts 99.99% purity, making it a favorite among purists. Coins like the Chinese Gold Panda and Mexican Gold Libertad also offer unique annual designs, appealing to both investors and collectors.

On the other hand, gold bullion—typically in the form of bars or rounds—is valued primarily for its metal content rather than aesthetics. Produced by renowned gold mints and gold refineries like the Perth Mint or Austrian Gold Philharmonic, bullion often features lower premiums compared to coins, making it a cost-effective choice for large-scale gold investment. Bullion comes in various gold bar weights (1 oz, 10 oz, 1 kg) and gold bar styles (cast or minted), with purities ranging from 99.5% to 99.99%. For instance, a 1-oz gold bar from a reputable refinery might trade closer to the gold spot price than a 1-oz Gold Krugerrand, which carries additional minting and distribution costs.

Here’s a quick comparison to help you decide:

- Liquidity: Coins like the American Gold Eagle or Canadian Gold Maple Leaf are globally recognized and easier to sell in smaller quantities, while larger bullion bars may require verification and incur higher resale fees.

- Premiums: Coins generally have higher premiums (5%–10% over spot) due to craftsmanship and demand, whereas bullion bars often trade at 1%–3% over spot.

- Storage: Bullion bars are stackable and space-efficient for bulk storage, while coins may need protective capsules or albums to preserve their condition.

- Purity: Most gold bullion coins (e.g., Austrian Gold Philharmonic) and bars boast 99.99% purity, but some coins (like the Gold American Eagle) use alloys for durability.

For wealth protection, coins offer legal tender status and counterfeit resistance due to advanced minting techniques, while bullion provides a straightforward, low-cost way to accumulate physical gold. If you’re prioritizing flexibility and recognition, government-minted coins are ideal. For maximizing metal content per dollar, bullion bars are the smarter play. Always verify the reputation of the mint or refinery—whether it’s the Perth Mint for coins or a LBMA-approved refinery for bars—to ensure authenticity and gold purity.

Professional illustration about Canadian

Gold Coin Collecting 101

Gold Coin Collecting 101: A Beginner’s Guide to Building a Valuable Portfolio

Starting a gold coin collection is one of the smartest ways to combine wealth protection with the thrill of owning tangible assets. Whether you're drawn to the artistry of gold coin designs or the stability of precious metals as a hedge against inflation, understanding the basics is key. The first step is knowing the major gold mints that produce the most sought-after coins. The Perth Mint, Royal Canadian Mint, and United States Mint (often referred to as the US Mint) are globally recognized for their high standards in gold purity and craftsmanship. Iconic coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand are staples in any serious collection, each offering unique designs and reliable gold bullion value.

When evaluating gold coins, prioritize gold purity—measured in karats or fineness. Most investment-grade coins, like the Austrian Gold Philharmonic or Chinese Gold Panda, are minted in .9999 fine gold, ensuring maximum value. However, some historic coins, like the Gold Krugerrand, are alloyed for durability but still hold significant worth due to their gold content and collectible status. Pay attention to gold premiums, which are the additional costs above the gold spot price. Limited-edition coins from the Mexican Gold Libertad series, for example, often carry higher premiums due to their rarity and artistic appeal.

Storage and authentication are critical for preserving your collection’s value. Always purchase from reputable dealers or directly from mints like the South African Mint or Perth Mint to avoid counterfeits. Consider third-party grading services to verify authenticity and condition, especially for older or rare coins. For new collectors, starting with gold bullion coins—which are valued primarily for their metal content—is a practical approach before diving into numismatic (collector) coins, which can have higher premiums based on historical significance or design uniqueness.

Diversification is another smart strategy. Mix government-backed coins like the Gold American Eagle with internationally recognized options such as the Canadian Gold Maple Leaf or Chinese Gold Panda to spread risk and take advantage of global demand. Keep an eye on market trends, as shifts in the gold spot price can influence the best times to buy or sell. Finally, remember that gold coin collecting isn’t just about gold investment—it’s about owning pieces of history, culture, and craftsmanship that endure as timeless stores of value.

Professional illustration about Krugerrand

Gold Coin Authentication

Gold Coin Authentication: How to Verify the Real Deal in 2025

When investing in gold coins like the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand, authentication is critical to protect your wealth protection strategy. With counterfeit coins becoming increasingly sophisticated, knowing how to verify authenticity ensures you’re getting genuine precious metals from trusted sources like the US Mint, Royal Canadian Mint, or Perth Mint. Here’s how to authenticate gold coins like a pro.

Start with the Basics: Weight and Dimensions

Every reputable mint adheres to strict standards for gold coin purity and weight. For example, a 1-ounce Gold American Eagle should weigh exactly 31.1035 grams (1 troy ounce) and measure 32.7mm in diameter. Even slight deviations could signal a fake. Use a precision scale and calipers to check—this is especially important for high-premium coins like the Chinese Gold Panda or Mexican Gold Libertad, which are frequently targeted by counterfeiters.

Examine the Design and Details

Authentic gold bullion coins feature sharp, intricate designs. Compare your coin to high-resolution images from the mint’s official website. Look for:

- Fine details: The Austrian Gold Philharmonic’s musical instruments or the Gold Krugerrand’s springbok should be crisp, not blurry.

- Edge lettering: Many coins, like the Canadian Gold Maple Leaf, have micro-engraved security features (e.g., radial lines or laser-etched markings).

- Fonts and spacing: Counterfeiters often mess up tiny details like the spacing between letters on the South African Mint’s inscriptions.

Test for Purity

While visual checks help, advanced methods like:

- Sigma Metalytics testers: These handheld devices measure electrical conductivity to verify gold purity without damaging the coin.

- Ultrasound thickness testers: Useful for detecting hidden tungsten cores (a common scam in fake gold bullion coins).

- XRF analyzers: Professional dealers use these to confirm the exact metal composition of coins like the American Gold Eagle or Gold Canadian Maple Leaf.

Buy from Trusted Sources

Stick to authorized dealers or direct purchases from mints like the United States Mint or Royal Canadian Mint. Avoid sketchy online marketplaces where "too good to be true" gold spot price deals often hide fakes. If you’re buying rare issues like the Chinese Gold Panda, request a certificate of authenticity—reputable sellers provide them.

Watch for Red Flags

- Unusual discoloration: Real gold doesn’t tarnish, so greenish hues or uneven coloring indicate plating.

- Magnet test: Gold isn’t magnetic. If your Gold Krugerrand sticks to a magnet, it’s a fake.

- Sound test: Genuine gold coins produce a distinct, resonant "ping" when lightly struck. Fakes sound dull.

Final Tip: Stay Updated

Counterfeit techniques evolve, so follow updates from mints like the Perth Mint or South African Mint on new security features. In 2025, many mints are embedding NFC chips or holograms in high-value coins like the Austrian Gold Philharmonic—another layer of protection for your gold investment.

By combining these methods, you’ll minimize risks and ensure your gold coins are legit. Whether you’re holding a Gold American Eagle or a Mexican Gold Libertad, authentication is the backbone of smart precious metals investing.

Professional illustration about Krugerrand

Gold Coin Tax Rules

Understanding Gold Coin Tax Rules in 2025

Investing in gold coins like the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand isn’t just about wealth protection—it’s also about navigating tax implications. In the U.S., the IRS treats gold bullion coins differently than collectibles, but the rules can get tricky. For example, gold coins produced by government mints like the US Mint, Royal Canadian Mint, or Perth Mint are often classified as "legal tender," which may offer tax advantages over generic gold bullion. However, profits from selling these coins are still subject to capital gains tax, with rates depending on how long you’ve held them (short-term vs. long-term).

Key Tax Considerations for Gold Coins

- Capital Gains Tax: If you sell your Gold American Eagle or Chinese Gold Panda for more than you paid, the profit is taxable. Long-term holdings (over one year) are taxed at a maximum rate of 28% for collectibles, while short-term gains align with your ordinary income tax bracket.

- Sales Tax Exemptions: Some states, like Texas and Florida, exempt precious metals from sales tax if purchases meet certain thresholds (e.g., over $1,000). Always check local laws, as this varies by state.

- IRA Eligibility: Coins like the Austrian Gold Philharmonic and Mexican Gold Libertad are IRA-approved, meaning you can hold them in a gold investment retirement account. Contributions may be tax-deductible, but distributions are taxed as ordinary income.

Spotlight on Popular Gold Coins and Their Tax Status

The American Gold Eagle, minted by the United States Mint, is one of the most tax-efficient options due to its legal tender status. Meanwhile, the South African Mint’s Gold Krugerrand—though iconic—is considered a collectible by the IRS, subjecting it to the 28% long-term capital gains rate. The Royal Canadian Mint’s Canadian Gold Maple Leaf, with its 99.99% gold purity, is also IRA-eligible, offering flexibility for retirement savers.

Pro Tip: Keep detailed records of your purchases, including the gold spot price at the time of acquisition and any gold premiums paid. This documentation is crucial for accurately calculating gains or losses when it’s time to sell.

International Gold Coins and Tax Nuances

If you own coins from foreign mints, like the Perth Mint’s offerings or the Chinese Gold Panda, be aware of reporting requirements. The U.S. requires disclosure of foreign-held assets exceeding $10,000, including gold bullion coins. Failure to report can result in penalties. Additionally, importing coins may trigger customs duties, though many gold coins are duty-free if they meet purity standards (e.g., .995 fine gold or higher).

Final Word on Minimizing Tax Liabilities

To optimize your gold investment strategy, consider holding coins long-term to qualify for lower capital gains rates. Pair this with tax-advantaged accounts like IRAs for added benefits. And remember, while gold coin designs and gold purity matter for collectors, tax efficiency should be a priority for investors. Always consult a tax professional to ensure compliance with the latest 2025 regulations.

Professional illustration about Chinese

Gold Coin Selling Guide

Selling gold coins can be a profitable venture if you understand the market dynamics and know where to find the right buyers. Whether you're dealing with American Gold Eagles, Canadian Gold Maple Leafs, or South African Gold Krugerrands, each coin carries unique value based on its origin, purity, and collector demand. The first step is identifying what you have – examine your coins for mint marks (like US Mint or Royal Canadian Mint), weight, and purity (typically .9999 for bullion coins). Premium collector coins like the Chinese Gold Panda or Mexican Gold Libertad often fetch higher prices than their gold content alone due to limited mintage and artistic designs.

Timing matters when selling. Monitor the gold spot price daily, as it directly impacts your coin's melt value. While bullion coins like the Austrian Gold Philharmonic track closely to spot prices, numismatic coins may follow different valuation rules. Consider selling when markets show upward momentum – many investors seek wealth protection during economic uncertainty, driving demand. For rare editions (like early Perth Mint releases), auction houses often yield better returns than dealers. Always get multiple appraisals; local coin shops might offer 3-5% under spot, while specialized online platforms could match or exceed it.

Presentation affects profitability. Keep coins in original capsules or holders, especially for graded specimens. A Gold American Eagle in perfect condition commands significantly more than one with scratches or milk spots. For bulk sales (e.g., full tubes of Gold Krugerrands), expect slight per-coin discounts compared to individual sales. Documentation matters – retain certificates of authenticity, especially for coins from prestigious mints like the South African Mint. Lastly, know your tax implications; in the U.S., gold coins are collectibles subject to 28% capital gains tax if held over a year. For frequent traders, reporting requirements kick in after selling 25+ ounces of .999+ purity gold.

Payment methods warrant caution. Cash deals carry risks but avoid paper trails, while bank wires or secure escrow services (for high-value sales) add protection. Be wary of buyers offering prices drastically above market – counterfeit schemes often target inexperienced sellers. If exploring niche markets (e.g., selling gold bullion to jewelry makers), verify the buyer's reputation through precious metals forums. For ultra-high-value collections, consider consignment with established dealers who have networks for coins like the Chinese Gold Panda or vintage Gold American Eagles. Remember, liquidity varies by coin type; government-minted coins generally sell faster than private refinery products. Always prioritize secure transactions over marginal price differences.

Professional illustration about Libertad

Gold Coin Dealer Tips

Choosing the right gold coin dealer in 2025 requires a mix of due diligence and market savvy. With gold coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand remaining popular for wealth protection, it’s crucial to work with reputable dealers who prioritize transparency. Always verify a dealer’s credentials—look for affiliations with industry groups like the Professional Numismatists Guild (PNG) or positive reviews on trusted platforms. For example, dealers sourcing directly from mints like the Perth Mint or Royal Canadian Mint often provide authenticity guarantees, reducing the risk of counterfeit coins.

Understand the gold spot price and premiums before buying. The gold spot price fluctuates daily, but reputable dealers will clearly explain premiums—the markup over the spot price—for coins like the Gold American Eagle or Chinese Gold Panda. Premiums vary based on factors like rarity, design, and mint (e.g., US Mint vs. Austrian Gold Philharmonic). For instance, limited-edition coins or those with intricate designs (like the Mexican Gold Libertad) may carry higher premiums. Compare prices across multiple dealers to avoid overpaying, and ask for a breakdown of fees, including shipping or insurance.

Prioritize dealers who offer detailed product information and certifications. A trustworthy dealer will disclose the gold purity (e.g., .9999 pure for the Canadian Gold Maple Leaf vs. .9167 for the Gold Krugerrand) and weight, along with proper certification for graded coins. Avoid dealers who are vague about origins or lack documentation—especially for bullion coins from smaller mints like the South African Mint. If you’re investing in larger quantities, inquire about bulk discounts or storage solutions, as some dealers partner with secure vaulting services.

Watch out for red flags like pressure tactics or unrealistic promises. Scammers often prey on new investors by claiming “limited-time offers” on gold bullion coins or guaranteeing inflated returns. Legitimate dealers won’t rush you into a purchase. For example, if someone pushes you to buy a Gold American Eagle without explaining market trends or gold coin designs, walk away. Similarly, be wary of prices significantly below the spot price—this could indicate counterfeit or stolen goods.

Consider the dealer’s buyback policy and liquidity. A reliable dealer will offer fair buyback terms for coins like the Austrian Gold Philharmonic or Gold Krugerrand, ensuring you can liquidate your investment if needed. Ask about their process: Do they base buyback prices on the current gold spot price? Are there fees? Dealers affiliated with major mints (e.g., Perth Mint’s authorized network) often provide smoother transactions. Finally, check if they educate customers—those who explain gold investment strategies or market trends add long-term value beyond the sale.

Diversify your sources for broader market insights. While sticking to one trusted dealer is convenient, exploring multiple platforms (online dealers, auctions, local shops) can reveal pricing trends for coins like the Chinese Gold Panda or Mexican Gold Libertad. For example, some dealers specialize in historic or numismatic coins, while others focus on gold bullion bars and newer mint releases. Networking with other investors or joining forums can also uncover dealer recommendations—just cross-verify any tips with independent research.

Final pro tip: Document every transaction. Whether you’re buying a single Gold American Eagle or a collection of Canadian Gold Maple Leafs, keep records of invoices, certifications, and communications. This protects you in disputes and simplifies tax reporting. If a dealer hesitates to provide paperwork—especially for high-purity coins like the .9999 Royal Canadian Mint products—consider it a major warning sign. In 2025, digital receipts and blockchain-based verification are becoming industry standards for authenticity tracking.

Professional illustration about Philharmonic

Gold Coin Price Factors

When it comes to gold coin price factors, several key elements determine how much you'll pay for that American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand. Understanding these variables can help you make smarter gold investment decisions while ensuring you're not overpaying for your precious metals.

The gold spot price is the baseline for all gold bullion coins, fluctuating in real-time based on global market demand. Whether you're buying from the US Mint, Perth Mint, or Royal Canadian Mint, the value of raw gold (measured per troy ounce) directly impacts the final cost. In 2025, economic factors like inflation, geopolitical tensions, and central bank policies continue to drive volatility in gold spot prices, making it essential to track market trends before purchasing.

Every mint charges a premium over the spot price, covering production costs, distribution, and branding. For example:

- The Gold American Eagle carries a higher premium than generic bars due to its iconic design and US Mint backing.

- The Austrian Gold Philharmonic often has lower premiums compared to other government-minted coins, making it a budget-friendly choice.

- Limited-edition releases, like the Chinese Gold Panda (with its annual design changes), can command even steeper premiums due to collector demand.

These markups vary by mint, so comparing premiums between the South African Mint, Royal Canadian Mint, and others can save you money.

Not all gold coins are created equal. Purity (measured in karats or fineness) affects both price and durability:

- 24-karat coins like the Canadian Gold Maple Leaf (99.99% pure) trade at higher prices due to their refined content.

- 22-karat coins like the Gold Krugerrand (91.67% pure) are more durable for handling but may sell at a slight discount compared to purer options.

- Weight also plays a role—larger coins (e.g., 1 oz vs. 1/10 oz) usually have lower premiums per ounce.

Certain gold coin designs carry numismatic value beyond their metal content. The Mexican Gold Libertad, for instance, is prized for its intricate artwork, while the Perth Mint’s lunar series attracts collectors. If you're buying for wealth protection, stick to bullion coins. But if you're open to collectible appreciation, rare editions from Royal Canadian Mint or vintage Gold American Eagles could yield long-term gains.

High-demand coins like the Gold American Eagle or South African Gold Krugerrand often sell faster and closer to spot price, whereas niche coins (e.g., Chinese Gold Panda) may take longer to liquidate. In 2025, global economic uncertainty has kept liquidity strong for major gold bullion coins, but always verify resale avenues before investing.

Where you buy matters. Online dealers typically offer better rates than brick-and-mortar stores, but shipping and payment fees (e.g., credit card surcharges) can add up. Paying via bank transfer often gets you the lowest price, while bulk purchases may unlock discounts.

By analyzing these gold coin price factors, you’ll navigate the market like a pro—whether you’re stacking Gold Krugerrands for stability or diversifying with Austrian Philharmonics. Keep an eye on gold spot price trends, compare mint premiums, and prioritize liquidity to maximize your precious metals portfolio.

Frequently Asked Questions

How much is a gold coin worth right now?

The value of a gold coin depends on its weight, purity, and current gold spot price. As of 2025, popular coins like the American Gold Eagle or Canadian Gold Maple Leaf typically trade at a 3-5% premium over the spot price. Key factors affecting value:

- Current gold spot price (check live markets)

- Coin's weight (e.g., 1 oz, 1/2 oz, 1/4 oz)

- Mint premium and collector demand

What are the best gold bullion coins to buy in 2025?

The top gold bullion coins combine liquidity, recognition, and government backing. In 2025, the most recommended options include: These coins are widely traded, have .999+ purity, and carry legal tender status for added security.

- American Gold Eagle (US Mint)

- Canadian Gold Maple Leaf (Royal Canadian Mint)

- Gold Krugerrand (South African Mint)

Can you still buy gold coins from banks in 2025?

Most commercial banks no longer sell physical gold coins directly to retail customers. In 2025, your best options are: Always verify dealer credentials through the Better Business Bureau before purchasing.

- Authorized precious metals dealers

- Government mints (like US Mint or Perth Mint websites)

- Reputable online bullion exchanges

How does the American Gold Eagle compare to the Canadian Gold Maple Leaf?

Both are top-tier bullion coins but have key differences. The Gold Eagle contains 91.67% gold (22k) with silver/copper alloy for durability, while the Maple Leaf is .9999 pure (24k). Consider:

- Eagles carry a higher premium but wider recognition

- Maple Leafs have finer purity but may scratch easier

- Both are IRA-eligible and VAT-exempt in their home countries

Is it better to buy gold coins or gold bars for investment?

Coins offer advantages over bars for most investors. While bars have lower premiums, coins provide: For amounts under $50,000, coins are generally the smarter choice.

- Greater liquidity and easier resale

- Government backing and anti-counterfeit features

- Potential numismatic value over time

What's the difference between proof and bullion gold coins?

Bullion coins are mass-produced for investors, while proof coins are collectible editions. Key distinctions:

- Proofs have mirror-like finishes and come in protective cases

- Bullion coins trade near metal value; proofs carry higher premiums

- Proofs have limited mintages and certification (e.g., PCGS graded)

Are gold coins from private mints as good as government mints?

Government-minted coins generally offer better security and liquidity. Private mint coins may have: Stick with sovereign mints like Perth Mint or Royal Canadian Mint for core holdings.

- Higher buy-sell spreads due to less recognition

- No legal tender status

- Variable quality control

How do I verify the authenticity of gold coins?

Use multiple verification methods for security. Recommended steps: For high-value coins, professional assay services are worth the cost.

- Check weight and dimensions against mint specifications

- Use a neodymium magnet (real gold isn't magnetic)

- Purchase from PCGS/NGC-certified slabs when possible

What taxes apply when buying gold coins in the US?

US tax treatment depends on purchase size and form. Key 2025 rules:

- No sales tax on bullion coins in most states (check local laws)

- Capital gains tax applies if sold for profit (collector rate if held <1 year)

- IRA purchases must use approved coins like Eagles or Maple Leafs

Why do some gold coins like Pandas or Libertads cost more than others?

Premium coins combine bullion value with collectible demand. Factors driving higher prices: These may appreciate beyond gold content but aren't ideal for pure bullion investors.

- Annual design changes (e.g., Chinese Gold Panda)

- Lower mintages (Mexican Libertad)

- Strong collector communities