In 2025, PayPal continues to dominate the digital payment landscape with its unbeatable combination of security, convenience, and global accessibility. As one of the most trusted online payment platforms, PayPal offers users 5 distinct advantages: military-grade encryption for fraud protection, lightning-fast transfers through Venmo integration, worldwide acceptance at millions of merchants, seamless Mastercard compatibility for checkout, and innovative cashback rewards programs. Whether you're sending money to family, shopping online, or running a business, PayPal's advanced features like One Touch checkout and purchase protection make financial transactions smoother than ever. With support for 200+ markets and 25+ currencies, this financial technology leader remains the go-to solution for secure digital payments across borders.

Professional illustration about Stripe

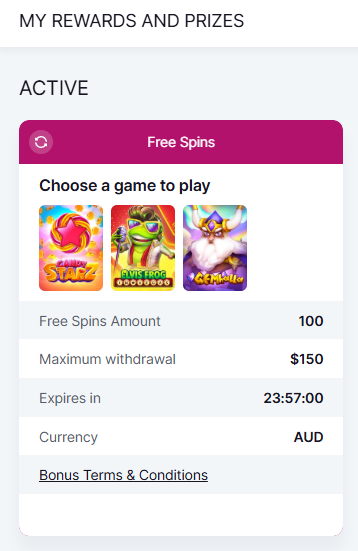

PayPal Sign Up Guide

Signing up for a PayPal account in 2025 is a straightforward process, but understanding the nuances can help you maximize its benefits as a digital wallet and payment processing tool. Whether you're an individual looking for seamless money transfers or a small business owner exploring small business solutions, PayPal offers a versatile platform with integrations like Venmo, eBay, and Zettle. To get started, head to the PayPal website or download the app, then click "Sign Up." You’ll choose between a personal account (ideal for casual users) or a business account (tailored for merchants). Personal accounts are great for sending/receiving funds, while business accounts unlock features like merchant fees customization and payment systems integration.

During registration, you’ll need to provide basic details like your name, email, and a secure password. PayPal prioritizes transaction security, so enabling two-factor authentication (2FA) is highly recommended. Once your email is verified, link a Mastercard, debit card, or bank account to fund transactions. PayPal’s end-to-end encryption ensures your financial data stays protected. For users interested in cryptocurrency, PayPal now supports buying, selling, and holding select crypto assets through its partnership with Paxos Trust Company. If you’re a freelancer or seller, consider linking Hyperwallet for streamlined payouts, or explore buy now pay later options like Paidy for flexible purchasing power.

For businesses, PayPal’s Simility fraud detection tools and Chargehound dispute resolution can save time and money. If you frequently sell on platforms like eBay or use Stripe for online payments, PayPal integrates seamlessly, reducing checkout friction. Synchrony Bank and WebBank back PayPal’s credit products, including cash-back rewards. Pro tip: If you’re planning international transactions, Xoom (a PayPal service) offers competitive exchange rates for cross-border transfers. After setup, customize your profile settings—adjust merchant fees, set up payment apps notifications, or enable cash back rewards for eligible purchases. Remember, PayPal’s financial technology evolves constantly, so regularly check for new features like The Bancorp Bank-backed debit cards or Paxos Trust Company-managed crypto services to stay ahead.

Professional illustration about Xoom

PayPal Fees Explained

Understanding PayPal Fees in 2025: A Breakdown for Users and Businesses

PayPal remains one of the most popular digital wallet and payment processing platforms, but its fee structure can be confusing. Whether you're sending money to friends via Venmo (owned by PayPal), selling on eBay, or running a small business, knowing how fees work is crucial. Here’s a detailed look at PayPal’s current fee model and how it compares to competitors like Stripe or Zettle.

Transaction Fees for Purchases and Sales

For most transactions, PayPal charges a standard fee of 2.99% + $0.49 per sale within the U.S. in 2025. International transactions cost more—typically 4.99% + a fixed fee based on the currency. For example, if you sell a $100 product to a buyer in Europe, you’d pay around $5.48 in fees. Small businesses using Hyperwallet or Paidy for payouts should note that additional cross-border fees may apply.

Peer-to-Peer (P2P) and Personal Transfers

Sending money to friends or family? If you use your PayPal balance, bank account, or Mastercard debit card, it’s free. However, using a credit card incurs a 2.9% + $0.30 fee. Xoom, PayPal’s international remittance service, has separate fees ranging from $0.99 to $4.99, depending on the transfer speed and destination.

Merchant Fees and Business Solutions

Business accounts have different tiers. PayPal’s Pay in 4 (buy now pay later service) charges merchants 3.49% + $0.49 per transaction. If you use Zettle for in-person payments, fees drop to 1.90% + $0.10 for contactless transactions. High-volume sellers might qualify for custom rates through Simility (PayPal’s fraud detection tool) or The Bancorp Bank partnerships.

Cryptocurrency and Cash Back Programs

Trading crypto via Paxos Trust Company (PayPal’s partner) incurs 1.5% to 2.3% per transaction, while cash back rewards on PayPal’s Synchrony Bank-issued credit cards range from 1% to 3%. Note that withdrawing crypto to an external wallet costs a network fee (e.g., Bitcoin’s variable gas fees).

Hidden Fees to Watch For

- Currency conversion: PayPal adds a 3.5% markup if you don’t let your bank or Mastercard handle the exchange.

- Chargebacks: Disputed payments via Chargehound or WebBank can result in $20 fees, even if you win the case.

- Instant Transfers: Moving money to your debit card costs 1.5% (max $15), while standard bank transfers are free but slower.

How to Reduce Fees

1. Link a bank account instead of a credit card for free P2P transfers.

2. Negotiate rates for high-volume sales (e.g., eBay sellers processing $10K+/month).

3. Use end-to-end encryption and two-factor authentication to avoid fraud-related losses.

4. Compare alternatives: Stripe might offer lower rates for subscription-based businesses, while Zettle is better for brick-and-mortar stores.

PayPal’s payment systems are versatile, but fees add up quickly. Always check the latest terms, especially if you’re using small business solutions or cryptocurrency features. For transaction security, enable two-factor authentication and monitor your account through Simility’s alerts.

Professional illustration about Zettle

PayPal Security Features

PayPal Security Features: Keeping Your Money and Data Safe in 2025

When it comes to digital wallets and online payment platforms, security is non-negotiable. PayPal has long been a leader in transaction security, offering multiple layers of protection to safeguard users’ financial data. One of the most robust features is end-to-end encryption, which ensures that every payment processed—whether through PayPal, Venmo, or Xoom—is scrambled and unreadable to hackers. This technology is especially critical for small business solutions, where high-volume transactions require airtight security.

For added protection, PayPal leverages two-factor authentication (2FA), requiring users to verify their identity via SMS or an authenticator app before accessing their accounts. This extra step significantly reduces the risk of unauthorized access, even if login credentials are compromised. In 2025, PayPal has also integrated advanced fraud detection tools powered by Simility, its AI-driven security platform. Simility analyzes transaction patterns in real time, flagging suspicious activity—like unusual login locations or large money transfers—before fraud occurs.

Merchants using PayPal Zettle or processing payments via Stripe benefit from payment processing safeguards, including automatic dispute resolution and chargeback protection. PayPal’s buy now, pay later services, like those offered through Paidy, also include fraud monitoring to prevent unauthorized installment purchases. Additionally, partnerships with trusted financial institutions like The Bancorp Bank, Synchrony Bank, and WebBank ensure that funds are held securely, whether for personal use or business payouts via Hyperwallet.

Cryptocurrency users aren’t left out either. PayPal’s collaboration with Paxos Trust Company ensures secure crypto transactions, with built-in transaction security measures like cold storage for digital assets. For sellers on platforms like eBay, PayPal’s Seller Protection program covers eligible transactions, reducing the risk of fraudulent chargebacks. Even cash back rewards and merchant fees are processed with transparency, so users always know where their money is going.

Finally, PayPal’s payment apps are designed with user control in mind. You can freeze your account instantly if you lose your device, and real-time alerts keep you informed of every transaction. Whether you’re sending money internationally through Xoom or splitting bills with Venmo, PayPal’s financial technology prioritizes safety without sacrificing convenience. With Mastercard-backed security standards and tools like Chargehound for automated dispute handling, PayPal remains a top choice for secure payment systems in 2025.

Professional illustration about Simility

PayPal Business Benefits

PayPal Business Benefits: Why It’s a Must-Have for Modern Entrepreneurs

For small businesses and large enterprises alike, PayPal remains one of the most versatile payment processing solutions in 2025. Its seamless integration with platforms like eBay, Stripe, and Zettle makes it a powerhouse for online payment platforms, offering everything from money transfers to buy now pay later options. One of the biggest advantages? Low merchant fees compared to traditional banking systems, especially for international transactions. Businesses can accept payments in multiple currencies, withdraw funds instantly, and even leverage Hyperwallet for streamlined payouts to freelancers or contractors.

Security is another standout feature. With end-to-end encryption, two-factor authentication, and fraud detection powered by Simility, PayPal ensures transaction security—a critical factor when handling sensitive financial data. For businesses dealing with cryptocurrency, PayPal’s partnership with Paxos Trust Company allows secure crypto transactions, while integrations with Venmo and Mastercard expand customer payment options. Plus, tools like Chargehound help dispute chargebacks efficiently, saving time and revenue.

For e-commerce, PayPal’s small business solutions shine. Features like Paidy (for flexible payment plans) and cash back rewards incentivize customer loyalty. Sellers can also use Xoom for low-cost international transfers or Synchrony Bank-backed credit lines to manage cash flow. The platform’s digital wallet functionality simplifies recurring billing, and its API works flawlessly with most payment apps and payment systems.

Here’s a pro tip: If you’re a high-volume seller, negotiate lower merchant fees with PayPal directly. Many businesses overlook this, but rates can drop significantly with consistent transaction volume. Also, explore The Bancorp Bank and WebBank integrations for specialized financial products tailored to your industry. Whether you’re a startup or an established brand, PayPal’s financial technology ecosystem adapts to your needs—making it a no-brainer for growth in 2025.

Bonus Insight: Use PayPal’s analytics dashboard to track customer behavior. Data like peak payment times or preferred methods (Venmo vs. credit cards) can optimize checkout flows and boost conversions.

Professional illustration about Company

PayPal Mobile App Tips

Maximizing the PayPal Mobile App for Seamless Transactions

The PayPal mobile app remains one of the most versatile digital wallet solutions in 2025, offering features that go beyond simple money transfers. Whether you're splitting bills with friends via Venmo (now fully integrated into PayPal's ecosystem) or managing small business solutions with Zettle, these tips will help you optimize your experience.

1. Enable Two-Factor Authentication for Enhanced Security

With rising concerns around transaction security, enabling two-factor authentication (2FA) is non-negotiable. Navigate to Settings > Security to activate this feature, which adds an extra layer of protection against unauthorized access. PayPal also uses end-to-end encryption for all transactions, but pairing it with 2FA ensures your account stays secure even if your login details are compromised.

2. Leverage Cash Back and Rewards

Did you know PayPal partners with Mastercard and other financial institutions like Synchrony Bank to offer cash back on eligible purchases? Link your preferred card to the app and check the Deals section regularly for limited-time offers. For example, shopping through PayPal at eBay often unlocks exclusive discounts or bonus rewards.

3. Simplify International Transfers with Xoom

If you frequently send money abroad, PayPal’s Xoom service (built into the app) provides competitive exchange rates and low merchant fees. Unlike traditional banks, transfers to most countries are completed within minutes. Pro tip: Always compare Xoom’s rates with other payment systems like Stripe or Hyperwallet for the best deal.

4. Use PayPal’s Cryptocurrency Features

Through its partnership with Paxos Trust Company, PayPal allows users to buy, sell, and hold cryptocurrency directly in the app. The Crypto Hub section provides real-time market trends and lets you convert crypto to USD instantly—ideal for traders or those experimenting with digital assets.

5. Optimize for Small Business Needs

For entrepreneurs, PayPal’s Zettle integration turns your phone into a POS system, while Simility (PayPal’s fraud detection tool) helps mitigate risks. Additionally, tools like Chargehound streamline dispute resolution, saving time on chargeback management. If you offer buy now pay later options, ensure your customers know PayPal’s Pay in 4 feature is available at checkout.

6. Automate Recurring Payments

Subscription-based businesses or freelancers can use PayPal’s Billing Agreements to set up automatic invoicing. This is especially useful for clients who pay via Paidy or other regional payment apps. Navigate to Tools > Billing to configure schedules and avoid missed payments.

7. Monitor Fees and Manage Cash Flow

While PayPal’s payment processing is convenient, fees can add up. Regularly review your Transaction Details to understand costs, especially for cross-border sales or currency conversions. For high-volume sellers, negotiating lower rates with PayPal (or alternatives like WebBank-backed solutions) might be worth exploring.

8. Utilize the App’s Built-In Budgeting Tools

The Spending Insights dashboard breaks down your transactions by category, helping you track expenses. Link accounts from The Bancorp Bank or other supported institutions for a consolidated view of your finances.

By mastering these features, you’ll transform the PayPal app from a basic online payment platform into a powerhouse for personal and business finance. Stay updated with the app’s 2025 enhancements—like AI-driven fraud alerts and expanded buy now pay later partnerships—to stay ahead in the financial technology space.

Professional illustration about Bancorp

PayPal International Transfers

PayPal International Transfers have become a cornerstone for global commerce, offering a seamless way to send and receive money across borders. In 2025, PayPal continues to dominate the digital wallet space, leveraging partnerships with Mastercard, eBay, and other major platforms to streamline cross-border transactions. Whether you're a freelancer getting paid by an overseas client or a small business owner using Zettle for in-person sales, PayPal’s international transfer features are designed to simplify financial interactions. One of the standout perks is the ability to hold multiple currencies in your account, reducing conversion fees when dealing with international clients.

For those who frequently send money abroad, PayPal’s subsidiary Xoom provides a specialized service with competitive exchange rates and options for cash pickup or direct bank deposits. Meanwhile, Hyperwallet (another PayPal service) caters to gig workers and marketplace sellers, ensuring fast payouts regardless of location. If you’re concerned about transaction security, PayPal employs end-to-end encryption and two-factor authentication to protect your funds. Small businesses relying on Stripe or Paidy for payment processing can also integrate PayPal to offer customers more flexibility, including buy now pay later options.

However, it’s important to note that merchant fees for international transfers can vary. PayPal typically charges a percentage of the transaction amount plus a fixed fee, which may differ based on the recipient’s country. For example, sending money to a friend in Europe might cost less than a business payment to Asia. To avoid surprises, always check the latest fee structure on PayPal’s website. Another pro tip: If you’re a frequent user, consider linking your PayPal account to The Bancorp Bank or Synchrony Bank for smoother withdrawals and additional cash back rewards.

Cryptocurrency enthusiasts will appreciate PayPal’s collaboration with Paxos Trust Company, allowing users to buy, sell, and hold digital assets like Bitcoin directly in their wallets. This feature is especially useful for international transfers, as crypto transactions often bypass traditional banking delays. On the fraud prevention side, PayPal’s acquisition of Simility and Chargehound has enhanced its ability to detect suspicious activity, giving users peace of mind when moving money globally.

For businesses, PayPal’s small business solutions include tools like WebBank-backed credit lines and invoicing features tailored for international clients. Freelancers can even set up recurring payments in multiple currencies, making it easier to manage long-term contracts. Whether you’re using Venmo for peer-to-peer transfers or PayPal for online payment platform needs, the system’s versatility makes it a top choice for anyone navigating the complexities of global finance in 2025.

Finally, if speed is a priority, PayPal’s payment apps often process international transfers within 1-3 business days, though expedited options may come with higher fees. Always compare rates with alternatives like Xoom or traditional wire transfers to ensure you’re getting the best deal. With its robust financial technology infrastructure and user-friendly interface, PayPal remains a go-to for secure, efficient cross-border transactions.

Professional illustration about Chargehound

PayPal Buyer Protection

PayPal Buyer Protection is one of the most trusted safeguards for online shoppers in 2025, offering peace of mind when using PayPal or its affiliated services like Venmo, Xoom, or Hyperwallet. This program ensures that buyers are covered if their purchase doesn’t arrive, is significantly different from the description, or is outright fraudulent. With the rise of financial technology and payment systems, PayPal’s transaction security measures—including two-factor authentication and end-to-end encryption—make it a top choice for secure transactions.

Here’s how it works: If you pay for an item using PayPal and the seller doesn’t deliver or misrepresents the product, you can file a dispute within 180 days of purchase. PayPal will investigate and may refund your money if the claim is valid. This applies to purchases made on platforms like eBay or through small business solutions that accept PayPal. However, there are exceptions—for example, cryptocurrency transactions, real estate, or vehicles aren’t covered.

For merchants, understanding PayPal Buyer Protection is crucial because it impacts merchant fees and dispute resolutions. If a buyer files a claim, sellers must provide proof of shipment or delivery, such as tracking numbers, to avoid losing the dispute. Services like Simility (PayPal’s fraud prevention tool) and Chargehound (for automated dispute responses) can help businesses minimize losses. Additionally, Stripe and Zettle users should note that while these platforms offer their own protections, PayPal’s policy is uniquely buyer-centric.

A key advantage in 2025 is PayPal’s integration with Mastercard and partnerships with banks like The Bancorp Bank, Synchrony Bank, and WebBank, which enhance payment processing reliability. For instance, if you use PayPal’s buy now pay later feature through Paidy, you’re still covered under Buyer Protection as long as PayPal processes the transaction.

Here are some best practices to maximize PayPal Buyer Protection:

- Always check that the seller’s website has a secure checkout (look for HTTPS).

- Use PayPal’s digital wallet for transactions instead of direct bank transfers.

- Keep records of all communications with the seller, including product descriptions and promises.

- Be wary of deals that seem too good to be true—scammers often exploit online payment platforms.

For international buyers, Xoom (PayPal’s international remittance service) also offers limited protection, but it’s best to review the terms before sending money abroad. Meanwhile, Paxos Trust Company ensures that cryptocurrency transactions via PayPal are secure, though they fall outside Buyer Protection.

In summary, PayPal Buyer Protection remains a cornerstone of secure payment apps, blending robust financial technology with user-friendly policies. Whether you’re a frequent online shopper or a merchant, understanding these safeguards can save time, money, and frustration in 2025’s fast-evolving digital wallet landscape.

PayPal Seller Protection

PayPal Seller Protection is a must-know feature for anyone running an online business in 2025, whether you're selling on eBay, using Zettle for in-person payments, or processing transactions through Stripe. This program is designed to safeguard merchants against fraudulent chargebacks, unauthorized transactions, and item-not-received claims—common headaches in the payment processing world. Here's how it works: When you meet PayPal's eligibility requirements (like providing proof of shipment or delivery), the company covers you for the full amount of the disputed transaction, minus any merchant fees.

One of the standout benefits is that PayPal integrates this protection seamlessly with other services in its ecosystem, including Venmo (for peer-to-peer sales) and Hyperwallet (for mass payouts). For example, if a customer files a chargeback after receiving a product through your online payment platform, PayPal’s team will review the case using advanced tools from Simility (their fraud prevention arm) to determine if you qualify for coverage. To maximize your chances, always use tracked shipping, document communications, and ensure your product descriptions are crystal clear—this helps combat "item-not-as-described" claims.

Security is another pillar of the program. PayPal employs end-to-end encryption and two-factor authentication to reduce risks, but sellers should also take extra steps. For instance, linking your account to The Bancorp Bank or Synchrony Bank (if you use PayPal’s buy now pay later options) adds another layer of transaction verification. Small businesses leveraging Xoom for cross-border sales or Paidy for Japanese markets can also benefit, as long as transactions comply with PayPal’s policy requirements.

Here’s a pro tip: Pair PayPal Seller Protection with third-party tools like Chargehound to automate dispute responses, or explore Paxos Trust Company’s solutions if you deal with cryptocurrency payments. The program doesn’t cover intangible goods (like e-books) or high-risk categories, so consider supplemental services like Mastercard’s fraud detection for those cases. Ultimately, understanding the fine print—such as time limits for filing claims or which payment apps are eligible—can save you thousands in lost revenue.

For high-volume sellers, PayPal offers additional resources through WebBank-backed lending programs or Zettle’s inventory management, turning Seller Protection into one piece of a larger financial technology strategy. Whether you’re a freelancer or a global e-commerce store, leveraging these features ensures your money transfers stay secure while minimizing disputes. Just remember: The program isn’t a substitute for good customer service. Proactive communication (like sending tracking updates) often prevents disputes before they escalate.

PayPal Credit Options

PayPal Credit Options

In 2025, PayPal continues to dominate the digital wallet space with a range of flexible credit options tailored for consumers and businesses. One of the most popular features is PayPal Credit, a revolving line of credit issued through Synchrony Bank, allowing users to finance purchases with buy now, pay later (BNPL) flexibility. With PayPal Credit, you can split payments into manageable installments, often with promotional 0% APR periods—perfect for big-ticket purchases on platforms like eBay or through payment processing partners like Stripe.

For small businesses, PayPal offers PayPal Business Loan and PayPal Working Capital, which provide quick funding based on your sales history. These solutions are ideal for merchants using Zettle for in-person payments or Hyperwallet for global payouts. Unlike traditional loans, repayment is tied to a percentage of daily sales, making cash flow management easier.

If you're looking for cash back rewards, the PayPal Cashback Mastercard (issued by Synchrony Bank) gives unlimited 2% back on purchases, redeemable directly into your PayPal balance. Meanwhile, Venmo (owned by PayPal) offers its Venmo Credit Card, which rewards users for spending in customizable categories like dining or transportation.

For those interested in cryptocurrency, PayPal has integrated with Paxos Trust Company to enable crypto purchases, sales, and even checkout conversions for eligible merchants. This adds another layer of flexibility for users who want to diversify their payment systems.

Security is a top priority, with two-factor authentication and end-to-end encryption safeguarding transactions. PayPal also leverages Simility for advanced fraud detection, ensuring that both buyers and sellers are protected from scams.

International users benefit from Xoom, PayPal’s money transfer service, which supports cross-border payments with competitive exchange rates. Meanwhile, Paidy (acquired by PayPal in recent years) offers BNPL solutions tailored for the Japanese market, showcasing PayPal’s global reach.

For dispute resolution, Chargehound simplifies chargeback management, helping merchants reduce losses from fraudulent claims. Whether you're a freelancer, a small business, or a frequent online shopper, PayPal’s financial technology ecosystem has a credit option to fit your needs.

Here’s a quick breakdown of key PayPal Credit Options in 2025:

- PayPal Credit: BNPL financing with deferred interest offers.

- PayPal Cashback Mastercard: 2% unlimited rewards on all purchases.

- PayPal Business Loan: Fixed-term financing for merchants.

- Venmo Credit Card: Customizable cash back via the Venmo app.

- Cryptocurrency Integration: Buy, hold, and spend crypto seamlessly.

- Xoom & Paidy: International money transfers and regional BNPL.

With so many choices, PayPal ensures that whether you're paying, getting paid, or growing a business, there’s a payment app or small business solution designed to optimize your financial workflow.

PayPal Debit Card Perks

Unlocking the Benefits of the PayPal Debit Card in 2025

The PayPal Debit Card isn’t just a plastic backup for your digital wallet—it’s a powerhouse of perks designed to streamline your spending while putting cash back in your pocket. Linked directly to your PayPal balance or bank account, this Mastercard-branded card lets you access funds instantly, whether you’re shopping online, in-store, or even withdrawing cash at ATMs. One of the standout features is the 1% cash back on eligible purchases, a no-strings-attached reward that adds up over time. For frequent shoppers on platforms like eBay, where PayPal is a preferred payment method, this perk turns everyday transactions into mini savings opportunities.

Security Meets Convenience

PayPal’s commitment to transaction security shines with its debit card. Every purchase is protected by end-to-end encryption and two-factor authentication, reducing fraud risks. If your card is lost or stolen, instant freezing via the PayPal app prevents unauthorized use. The card also integrates seamlessly with PayPal’s payment systems, including Venmo for peer-to-peer transfers and Xoom for international money transfers. For small business owners using Zettle or Hyperwallet, the debit card simplifies cash flow management by providing immediate access to sales revenue without waiting for bank transfers.

Exclusive Merchant Perks and Financial Flexibility

Holders of the PayPal Debit Card enjoy exclusive discounts at select retailers, a perk that’s frequently updated in the app’s “Offers” section. For example, users might snag 5% back at coffee chains or discounts on Stripe-powered subscription services. The card also supports buy now, pay later options through PayPal’s Pay-in-4 feature, letting you split purchases into interest-free installments. Meanwhile, partnerships with The Bancorp Bank and Synchrony Bank ensure FDIC insurance on eligible balances, adding a layer of financial safety.

Cryptocurrency and Beyond

For those dabbling in cryptocurrency, the PayPal Debit Card offers a unique advantage: the ability to spend crypto holdings directly at merchants (converted to USD at checkout). This feature, backed by Paxos Trust Company, bridges the gap between digital assets and everyday spending. Additionally, the card’s integration with Simility’s fraud detection tech minimizes false declines while keeping scams at bay—a boon for high-volume users.

Small Business Solutions

Freelancers and entrepreneurs benefit from the card’s small business solutions, like instant access to PayPal Working Capital loans or Chargehound dispute resolution tools. With no monthly fees and low merchant fees for in-person transactions, it’s a cost-effective alternative to traditional business banking. Plus, the card’s compatibility with Paidy and other global payment apps makes it a versatile tool for cross-border commerce.

The Bottom Line

From cash-back rewards to ironclad security, the PayPal Debit Card is more than a spending tool—it’s a financial hub for modern consumers and businesses. Whether you’re splitting bills with Venmo, selling on eBay, or managing a side hustle, its perks are tailored to fit the evolving landscape of financial technology in 2025. Just remember to activate offers in the app and monitor your cash-back balance to maximize value.

PayPal Cryptocurrency Guide

PayPal Cryptocurrency Guide

In 2025, PayPal continues to dominate as a leading online payment platform, and its integration of cryptocurrency has revolutionized how users buy, sell, and hold digital assets. With partnerships like Paxos Trust Company facilitating crypto transactions, PayPal offers a seamless way to trade Bitcoin, Ethereum, Litecoin, and Bitcoin Cash—all within its digital wallet. For beginners, the process is straightforward: link your PayPal account, verify your identity, and start trading with just a few clicks. One standout feature is the ability to use crypto for purchases at millions of merchants, including eBay, where PayPal is a preferred payment processing method.

Security remains a top priority, with end-to-end encryption and two-factor authentication safeguarding transactions. PayPal’s acquisition of Simility enhances fraud detection, while its collaboration with The Bancorp Bank and Synchrony Bank ensures regulatory compliance. For small businesses, PayPal’s merchant fees are competitive, especially when compared to alternatives like Stripe or Square. The platform also supports money transfers via Xoom and Hyperwallet, making it a versatile tool for global transactions.

Here’s what makes PayPal’s crypto service unique:

- Instant conversions: Cash out crypto to USD instantly, with funds available for spending or transferring.

- Cash back rewards: Some PayPal-linked credit cards, like those from Mastercard, offer cash back on crypto purchases.

- Buy Now, Pay Later (BNPL): Services like Paidy (owned by PayPal) allow users to split crypto-based purchases into interest-free installments.

For merchants, PayPal’s small business solutions include Zettle for in-person payments and Chargehound for dispute resolution. The platform’s financial technology stack ensures low transaction security risks, appealing to both crypto enthusiasts and traditional users. Whether you’re a freelancer receiving payments or a shopper leveraging payment apps like Venmo (also under PayPal), cryptocurrency integration adds flexibility to your payment systems.

Pro tip: If you’re new to crypto, start small. PayPal’s user-friendly interface lets you track market trends and set price alerts, reducing the learning curve. And with WebBank backing its lending services, even crypto-backed loans are becoming a reality. As the digital economy grows, PayPal’s ecosystem—from Paxos Trust Company-powered trades to Hyperwallet payouts—positions it as a one-stop shop for modern financial technology needs.

PayPal Dispute Resolution

PayPal Dispute Resolution is a critical feature for users who rely on the platform for secure money transfers and payment processing. Whether you're a small business owner using PayPal Zettle or an individual sending funds via Venmo, disputes can arise due to unauthorized transactions, item not received, or quality disagreements. In 2025, PayPal has streamlined its resolution process to be faster and more transparent, leveraging advanced financial technology like Simility for fraud detection and Paxos Trust Company for cryptocurrency-related disputes.

When a dispute is filed, PayPal acts as a mediator between buyers and sellers. For example, if you purchase an item on eBay and it arrives damaged, you can open a dispute within 180 days. PayPal’s system will prompt you to communicate directly with the seller first—this step resolves nearly 60% of cases without escalation. If no agreement is reached, the dispute escalates to a claim, where PayPal’s team reviews evidence like tracking numbers, photos, or chat logs. Merchants using Stripe or Hyperwallet should note that providing detailed documentation (e.g., proof of delivery) significantly improves their chances of winning a claim.

For transaction security, PayPal employs end-to-end encryption and two-factor authentication to minimize fraudulent disputes. However, if you encounter an unauthorized charge linked to your Mastercard or another funding source, PayPal’s Buyer Protection program may cover the full amount. Small businesses should also be aware of merchant fees tied to disputes—losing a claim often means forfeiting the transaction amount plus a $20 fee. Platforms like Chargehound can help automate dispute responses, saving time and reducing losses.

One of the newer features in 2025 is PayPal’s integration with buy now pay later services like Paidy. If a dispute involves a deferred payment, the resolution process adjusts to the installment timeline, ensuring neither party is unfairly penalized. Additionally, users of Xoom for international transfers benefit from localized dispute support, reducing language barriers and delays.

Here’s a pro tip: Always keep records. Whether you’re a freelancer paid via PayPal or a consumer using payment apps, screenshots, emails, and tracking details are your best defense in a dispute. For small business solutions, consider linking your account to WebBank or Synchrony Bank for added dispute management tools. By understanding PayPal’s policies and preparing evidence in advance, you can navigate disputes confidently—and keep your digital wallet secure.

PayPal Rewards Program

The PayPal Rewards Program is one of the most compelling reasons to use this digital wallet for everyday purchases, online shopping, and even small business solutions. Unlike traditional credit card rewards, PayPal’s program is deeply integrated with its payment processing ecosystem, offering cash back, exclusive discounts, and even cryptocurrency incentives. For instance, the PayPal Cashback Mastercard gives users 2% back on all purchases, while the PayPal Extras Mastercard offers 3% back on PayPal and eBay purchases, 2% on gas, restaurants, and drugstores, and 1% on everything else. Both cards are issued by Synchrony Bank, ensuring seamless integration with your PayPal account.

What sets PayPal apart is its ability to stack rewards across its network of services, including Venmo, Xoom, and Hyperwallet. For example, linking your PayPal Cashback Mastercard to Venmo for peer-to-peer payments can still earn you rewards, a feature rarely found in other payment apps. Small business owners using Zettle or Stripe for payment systems can also benefit from discounted merchant fees when opting into PayPal’s rewards structure. Additionally, PayPal’s buy now pay later service (powered by Paidy) occasionally offers bonus cashback for eligible purchases, making it a flexible option for budget-conscious shoppers.

Security is another standout feature of the rewards program. PayPal employs end-to-end encryption, two-factor authentication, and fraud detection tools from Simility to ensure transaction security. This means you can earn rewards without compromising safety—a major advantage over standalone credit cards. For crypto enthusiasts, PayPal’s partnership with Paxos Trust Company allows rewards to be redeemed as Bitcoin or Ethereum, adding a modern twist to traditional cashback programs.

Here’s a pro tip: If you’re a frequent online shopper, always check PayPal’s “Deals” section before checkout. Retailers like eBay often run exclusive promotions (e.g., 5% back) that stack with your card rewards. Similarly, businesses using Chargehound for dispute resolution can leverage PayPal’s rewards to offset chargeback costs. The program’s versatility—whether you’re sending money via Xoom, paying with Zettle in-store, or splitting bills on Venmo—makes it a must-consider for anyone serious about maximizing their spending power in 2025.

For high-volume users, PayPal’s rewards can be even more lucrative. Linking your account to The Bancorp Bank or WebBank-backed services (like certain buy now pay later options) can unlock higher cashback tiers or waived fees. The key is to actively use PayPal’s suite of tools—from money transfers to online payment platforms—to compound benefits. For example, freelancers paid via Hyperwallet can automatically divert earnings into a PayPal savings envelope, earning incremental rewards while budgeting. It’s this level of integration that keeps PayPal ahead of competitors in the financial technology space.

One underrated aspect? The program’s transparency. Unlike some rewards systems with obscure point valuations, PayPal’s cashback is straightforward: every dollar earned is a dollar redeemable. No blackout dates or category rotations—just consistent value. Whether you’re a casual user or a small business leveraging PayPal’s merchant solutions, the rewards program adapts to your spending habits, making it one of the most user-friendly options in the market today.

PayPal Integration Methods

Integrating PayPal into your business or personal payment system in 2025 offers multiple flexible options tailored to different needs, from small business solutions to large-scale payment processing platforms. PayPal’s ecosystem now supports seamless integration with Venmo, Mastercard, eBay, and third-party platforms like Stripe, making it one of the most versatile online payment platforms available. Whether you’re a freelancer accepting payments or an e-commerce store looking for transaction security, PayPal’s APIs, plugins, and partnerships provide robust functionality. For example, merchants can embed PayPal’s buy now pay later options directly into checkout pages, while developers can leverage SDKs for custom payment systems integration.

One of the most popular methods is using PayPal Checkout, which allows customers to pay via their digital wallet or credit/debit cards with two-factor authentication for added security. This is ideal for businesses using platforms like eBay or Zettle, as it reduces friction during checkout. For developers, PayPal’s REST API offers granular control over money transfers, subscriptions, and even cryptocurrency transactions (powered by Paxos Trust Company). Meanwhile, Hyperwallet and Xoom integrations cater to global sellers needing cross-border payout solutions, with support for multiple currencies and localized merchant fees.

Small businesses can also benefit from PayPal Here, a mobile POS system that syncs with invoicing tools and accounting software. For subscription-based models, PayPal’s Billing Agreements API automates recurring payments, while Simility (PayPal’s fraud prevention tool) ensures end-to-end encryption for sensitive data. If you’re handling disputes, Chargehound simplifies chargeback management, and Paidy streamlines cash back promotions for Japanese markets. Financial institutions like The Bancorp Bank, Synchrony Bank, and WebBank further enhance PayPal’s lending and credit services, offering flexible financing options.

For those prioritizing speed, PayPal Instant Transfer (backed by Mastercard and Venmo) moves funds to linked bank accounts in minutes—a game-changer for freelancers and gig workers. Advanced users can explore PayPal Commerce Platform, which supports multi-account management, marketplace escrow, and custom payment apps. Regardless of your integration method, PayPal’s financial technology stack in 2025 is designed to scale with your needs, balancing user convenience with enterprise-grade security. Pro tip: Always test your integration in PayPal’s sandbox environment before going live to avoid hiccups in transaction security or compliance.

PayPal Future Trends

PayPal Future Trends

As we move deeper into 2025, PayPal continues to evolve beyond being just a digital wallet or payment processing platform. With strategic acquisitions like Venmo, Hyperwallet, and Paidy, PayPal is positioning itself as a one-stop financial ecosystem. One of the most anticipated trends is the expansion of buy now, pay later (BNPL) services, which now integrate seamlessly with eBay and other major e-commerce platforms. This feature not only attracts younger consumers but also boosts merchant sales by offering flexible payment options.

Security remains a top priority, and PayPal is doubling down on transaction security with advanced two-factor authentication and end-to-end encryption. The company’s fraud prevention tools, powered by Simility, now use AI to detect suspicious activities in real-time, reducing merchant fees associated with chargebacks. Small businesses, in particular, benefit from PayPal Zettle, a point-of-sale solution that simplifies in-person and online transactions.

Cryptocurrency is another area where PayPal is making waves. Partnering with Paxos Trust Company, the platform now supports Bitcoin, Ethereum, and other cryptocurrencies, allowing users to buy, sell, and hold digital assets directly in their wallets. This move aligns with the growing demand for financial technology innovations, especially among tech-savvy audiences. Additionally, PayPal Xoom has enhanced cross-border money transfers, offering competitive exchange rates and faster processing times compared to traditional banks.

Competition is heating up, with rivals like Stripe and Mastercard introducing similar features. However, PayPal’s edge lies in its extensive partnerships with institutions like The Bancorp Bank, Synchrony Bank, and WebBank, which enable unique financing options like cash back rewards and installment plans. The company is also investing heavily in small business solutions, including Chargehound for dispute resolution, streamlining operations for merchants.

Looking ahead, PayPal’s focus on payment apps and online payment platforms will likely include more AI-driven personalization, such as tailored rewards and spending insights. The integration of Hyperwallet has already improved payouts for freelancers and marketplace sellers, while Paidy’s buy-now-pay-later model is gaining traction in international markets. Whether you’re a consumer, freelancer, or business owner, PayPal’s future trends promise greater convenience, security, and flexibility in the ever-changing landscape of payment systems.

Frequently Asked Questions

Can someone access your bank account through PayPal?

No, PayPal acts as a secure intermediary, so your bank account details are never directly shared with merchants or other users. Transactions are processed through PayPal's encrypted system. Key points: 1) PayPal uses end-to-end encryption to protect financial data. 2) Two-factor authentication adds an extra layer of security. 3) You can review all transactions in your activity log.

Is PayPal owned by Elon Musk?

No, Elon Musk was an early investor in PayPal but hasn't been involved since eBay acquired it in 2002. As of 2025, PayPal is an independent publicly traded company (NASDAQ: PYPL). Key points: 1) Musk co-founded X.com which merged with Confinity to form PayPal. 2) Current major shareholders include institutional investors like Vanguard and BlackRock. 3) PayPal operates independently with its own executive team.

Do you need a bank account to use PayPal?

No, you can use PayPal without linking a bank account by funding transactions through credit/debit cards or PayPal balance. However, some features require verification. Key points: 1) You can receive payments without a bank account. 2) Withdrawal options may be limited without bank linkage. 3) Prepaid cards from Mastercard or other providers can be used instead.

How do I talk to a live person at PayPal?

You can contact PayPal customer service by calling 1-888-221-1161 or through the Message Center in your account. Response times vary by issue complexity. Key points: 1) Phone support available 6am-6pm PT. 2) Twitter @AskPayPal offers quick responses. 3) Business accounts get priority support options.

What are the main disadvantages of using PayPal?

While convenient, PayPal has some drawbacks including fees for certain transactions and account holds for suspicious activity. Some merchants don't accept it. Key points: 1) International conversion fees up to 4%. 2) Dispute resolution can be slow. 3) Account limitations may freeze funds temporarily.

Can PayPal automatically withdraw money from my bank account?

PayPal only withdraws funds with your authorization for specific transactions or if you've set up automatic payments. Unauthorized withdrawals are rare. Key points: 1) Recurring payments require prior approval. 2) You can cancel automatic payments anytime. 3) Bank transfers typically take 1-3 business days.

How does PayPal compare to Venmo for personal payments?

PayPal offers more business features and global reach, while Venmo focuses on social payments among friends in the US. Both are owned by PayPal Holdings. Key points: 1) PayPal works with more merchants worldwide. 2) Venmo has social feed functionality. 3) PayPal offers better buyer/seller protection.

Is PayPal safer than using my credit card directly?

PayPal can be safer as it hides your financial details from merchants and offers purchase protection. However, both methods use strong security measures. Key points: 1) PayPal doesn't share card numbers with sellers. 2) 24/7 fraud monitoring by Simility. 3) Both offer zero-liability policies for unauthorized charges.

What banks does PayPal use for its services?

PayPal partners with several FDIC-insured banks including The Bancorp Bank, Synchrony Bank, and WebBank to provide various financial products. Key points: 1) Debit cards issued through Bancorp. 2) Credit products via Synchrony. 3) Business accounts may use different partner banks.

Can I use PayPal with eBay in 2025?

Yes, PayPal remains a payment option on eBay despite no longer being the primary processor. Buyers can choose PayPal at checkout. Key points: 1) Still accepted for most purchases. 2) Seller fees may differ from eBay's managed payments. 3) Buyer protection still applies to PayPal transactions.